Question: Your Task You were recently hired as an assistant controller at Safe Smiles Protective Masks Inc. (Safe Smiles). Your employer manufactures and sells a single

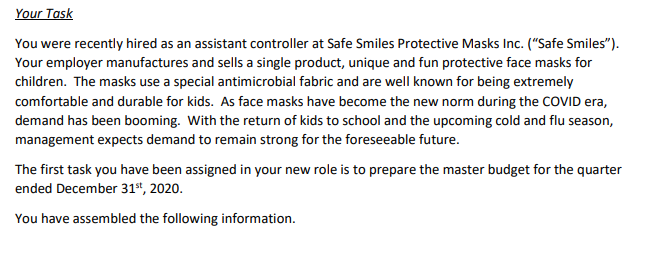

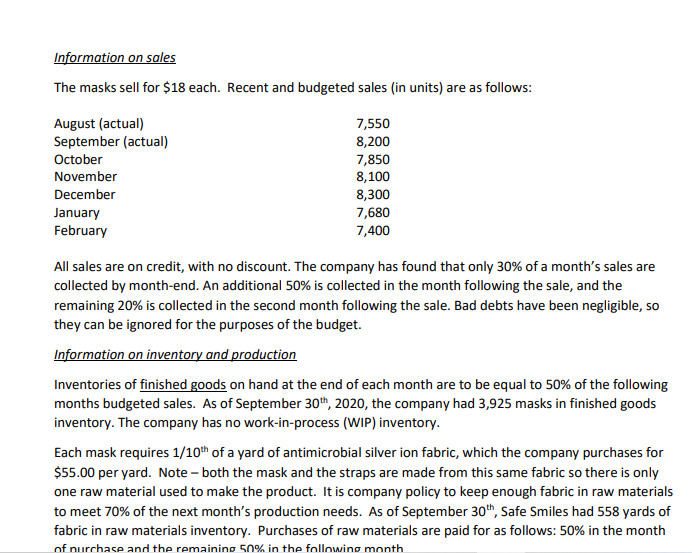

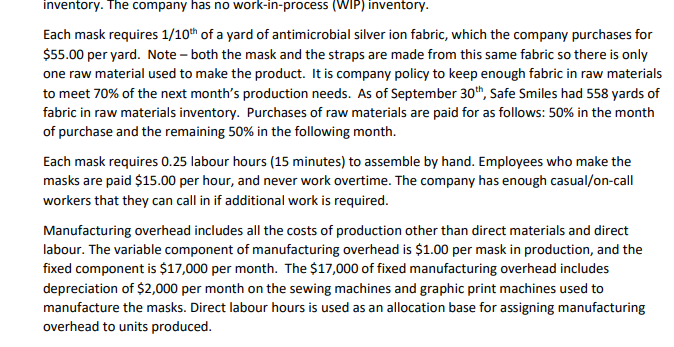

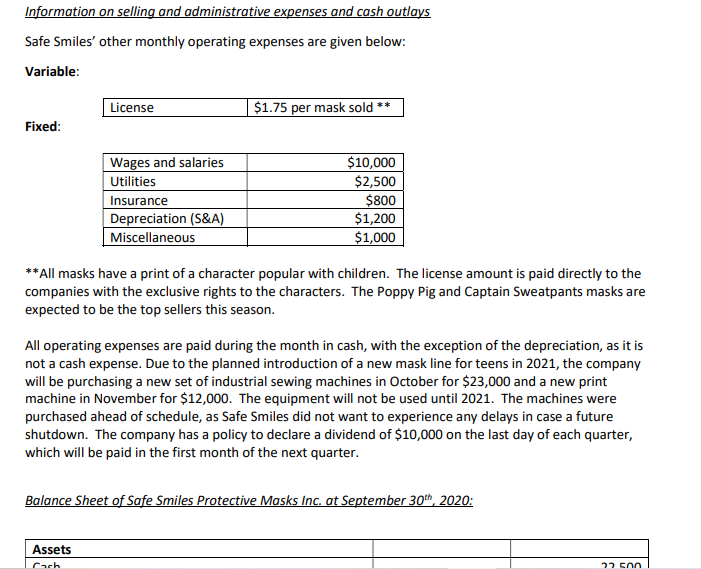

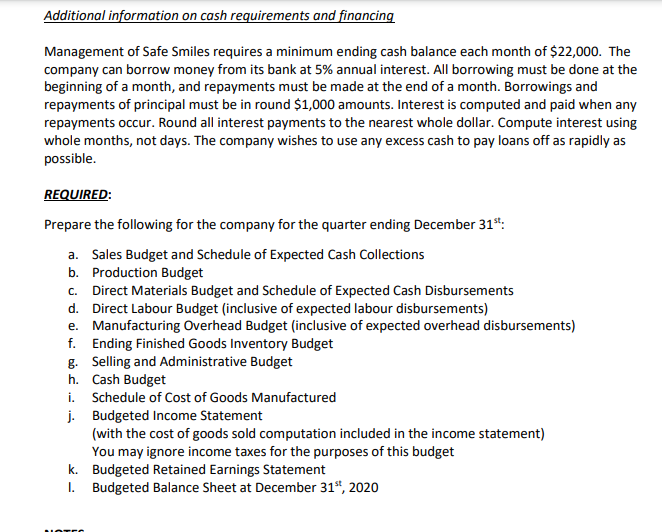

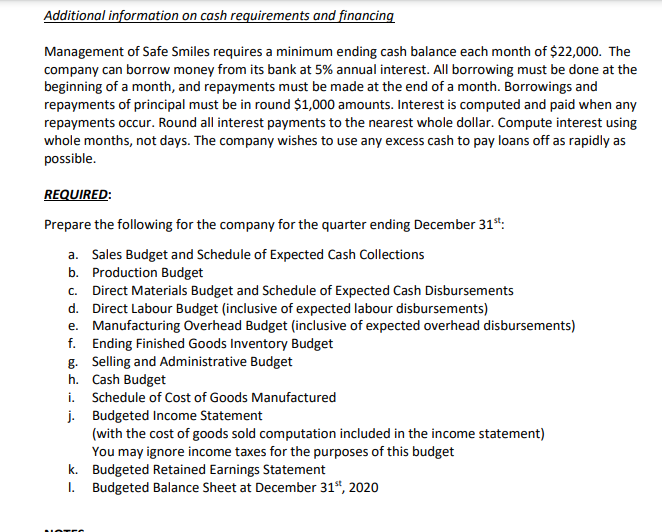

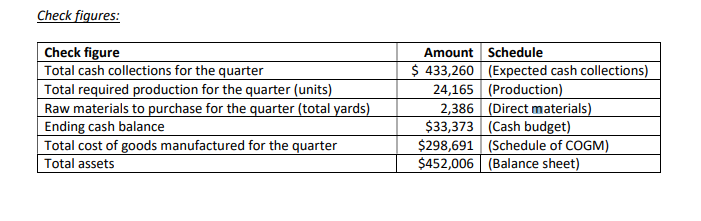

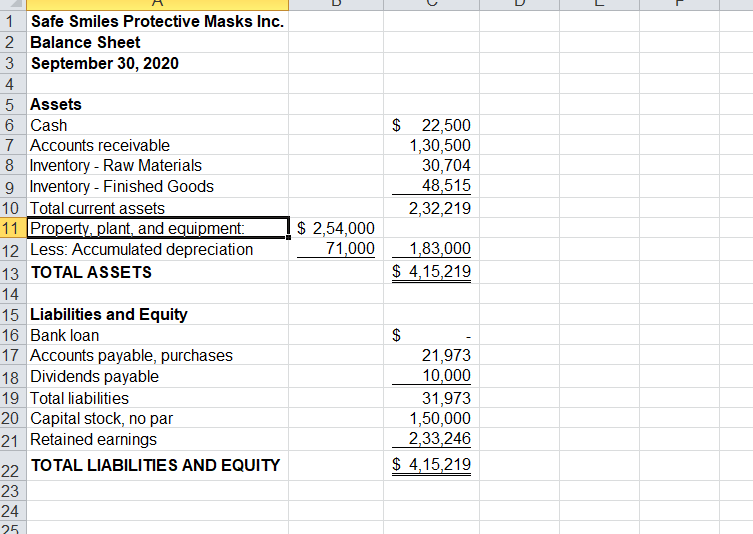

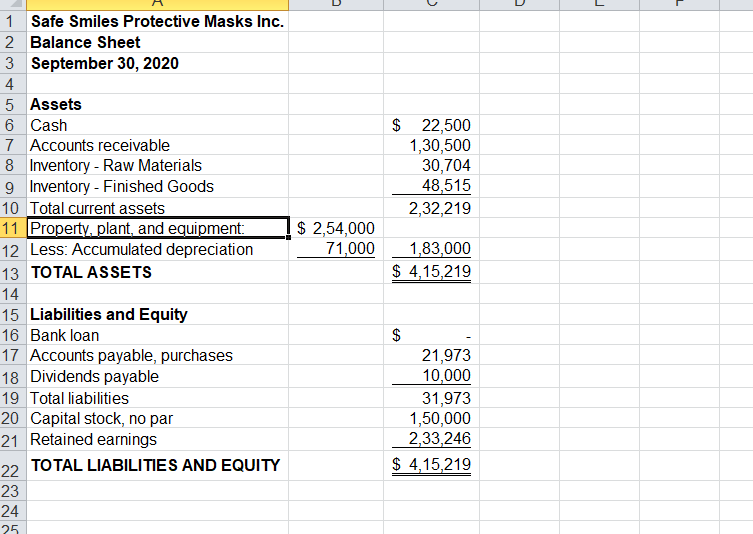

Your Task You were recently hired as an assistant controller at Safe Smiles Protective Masks Inc. ("Safe Smiles"). Your employer manufactures and sells a single product, unique and fun protective face masks for children. The masks use a special antimicrobial fabric and are well known for being extremely comfortable and durable for kids. As face masks have become the new norm during the COVID era, demand has been booming. With the return of kids to school and the upcoming cold and flu season, management expects demand to remain strong for the foreseeable future. The first task you have been assigned in your new role is to prepare the master budget for the quarter ended December 31st, 2020. You have assembled the following information. Information on sales The masks sell for $18 each. Recent and budgeted sales (in units) are as follows: August (actual) September (actual) October November December January February 7,550 8,200 7,850 8,100 8,300 7,680 7,400 All sales are on credit, with no discount. The company has found that only 30% of a month's sales are collected by month-end. An additional 50% is collected in the month following the sale, and the remaining 20% is collected in the second month following the sale. Bad debts have been negligible, so they can be ignored for the purposes of the budget. Information on inventory and production Inventories of finished goods on hand at the end of each month are to be equal to 50% of the following months budgeted sales. As of September 30th, 2020, the company had 3,925 masks in finished goods inventory. The company has no work-in-process (WIP) inventory. Each mask requires 1/10th of a yard of antimicrobial silver ion fabric, which the company purchases for $55.00 per yard. Note - both the mask and the straps are made from this same fabric so there is only one raw material used to make the product. It is company policy to keep enough fabric in raw materials to meet 70% of the next month's production needs. As of September 30th, Safe Smiles had 558 yards of fabric in raw materials inventory. Purchases of raw materials are paid for as follows: 50% in the month of nurchase and the remaining 50% in the following month inventory. The company has no work-in-process (WIP) inventory. Each mask requires 1/10th of a yard of antimicrobial silver ion fabric, which the company purchases for $55.00 per yard. Note - both the mask and the straps are made from this same fabric so there is only one raw material used to make the product. It is company policy to keep enough fabric in raw materials to meet 70% of the next month's production needs. As of September 30th, Safe Smiles had 558 yards of fabric in raw materials inventory. Purchases of raw materials are paid for as follows: 50% in the month of purchase and the remaining 50% in the following month. Each mask requires 0.25 labour hours (15 minutes) to assemble by hand. Employees who make the masks are paid $15.00 per hour, and never work overtime. The company has enough casual/on-call workers that they can call in if additional work is required. Manufacturing overhead includes all the costs of production other than direct materials and direct labour. The variable component of manufacturing overhead is $1.00 per mask in production, and the fixed component is $17,000 per month. The $17,000 of fixed manufacturing overhead includes depreciation of $2,000 per month on the sewing machines and graphic print machines used to manufacture the masks. Direct labour hours is used as an allocation base for assigning manufacturing overhead to units produced. Information on selling and administrative expenses and cash outlays Safe Smiles' other monthly operating expenses are given below: Variable: License $1.75 per mask sold ** Fixed: Wages and salaries Utilities Insurance Depreciation (S&A) Miscellaneous $10,000 $2,500 $800 $1,200 $1,000 **All masks have a print of a character popular with children. The license amount is paid directly to the companies with the exclusive rights to the characters. The Poppy Pig and Captain Sweatpants masks are expected to be the top sellers this season. All operating expenses are paid during the month in cash, with the exception of the depreciation, as it is not a cash expense. Due to the planned introduction of a new mask line for teens in 2021, the company will be purchasing a new set of industrial sewing machines in October for $23,000 and a new print machine in November for $12,000. The equipment will not be used until 2021. The machines were purchased ahead of schedule, as Safe Smiles did not want to experience any delays in case a future shutdown. The company has a policy to declare a dividend of $10,000 on the last day of each quarter, which will be paid in the first month of the next quarter. Balance Sheet of Safe Smiles Protective Masks Inc. at September 30th, 2020: Assets Cach E Additional information on cash requirements and financing Management of Safe Smiles requires a minimum ending cash balance each month of $22,000. The company can borrow money from its bank at 5% annual interest. All borrowing must be done at the beginning of a month, and repayments must be made at the end of a month. Borrowings and repayments of principal must be in round $1,000 amounts. Interest is computed and paid when any repayments occur. Round all interest payments to the nearest whole dollar. Compute interest using whole months, not days. The company wishes to use any excess cash to pay loans off as rapidly as possible. REQUIRED: Prepare the following for the company for the quarter ending December 31st: a. Sales Budget and Schedule of Expected Cash Collections b. Production Budget C. Direct Materials Budget and Schedule of Expected Cash Disbursements d. Direct Labour Budget (inclusive of expected labour disbursements) e Manufacturing Overhead Budget (inclusive of expected overhead disbursements) f. Ending Finished Goods Inventory Budget g. Selling and Administrative Budget h. Cash Budget i. Schedule of Cost of Goods Manufactured j. Budgeted Income Statement (with the cost of goods sold computation included in the income statement) You may ignore income taxes for the purposes of this budget k. Budgeted Retained Earnings Statement 1. Budgeted Balance Sheet at December 31st, 2020 Additional information on cash requirements and financing Management of Safe Smiles requires a minimum ending cash balance each month of $22,000. The company can borrow money from its bank at 5% annual interest. All borrowing must be done at the beginning of a month, and repayments must be made at the end of a month. Borrowings and repayments of principal must be in round $1,000 amounts. Interest is computed and paid when any repayments occur. Round all interest payments to the nearest whole dollar. Compute interest using whole months, not days. The company wishes to use any excess cash to pay loans off as rapidly as possible. REQUIRED: Prepare the following for the company for the quarter ending December 31st: a. Sales Budget and Schedule of Expected Cash Collections b. Production Budget C. Direct Materials Budget and Schedule of Expected Cash Disbursements d. Direct Labour Budget (inclusive of expected labour disbursements) e Manufacturing Overhead Budget (inclusive of expected overhead disbursements) f. Ending Finished Goods Inventory Budget g. Selling and Administrative Budget h. Cash Budget i. Schedule of Cost of Goods Manufactured j. Budgeted Income Statement (with the cost of goods sold computation included in the income statement) You may ignore income taxes for the purposes of this budget k. Budgeted Retained Earnings Statement 1. Budgeted Balance Sheet at December 31st, 2020 Check figures: Check figure Total cash collections for the quarter Total required production for the quarter (units) Raw materials to purchase for the quarter (total yards) Ending cash balance Total cost of goods manufactured for the quarter Total assets Amount Schedule $ 433,260 (Expected cash collections) 24,165 (Production) 2,386 (Direct materials) $33,373 (Cash budget) $298,691 (Schedule of COGM) $452,006 (Balance sheet) > L 1 $ 22,500 1,30,500 30,704 48,515 2,32,219 $ 2,54,000 71,000 1 Safe Smiles Protective Masks Inc. 2 Balance Sheet 3 September 30, 2020 4 5 Assets 6 Cash 7 Accounts receivable 8 Inventory - Raw Materials 9 Inventory - Finished Goods 10 Total current assets 11 Property, plant, and equipment: 12 Less: Accumulated depreciation 13 TOTAL ASSETS 14 15 Liabilities and Equity 16 Bank loan 17 Accounts payable, purchases 18 Dividends payable 19 Total liabilities 20 Capital stock, no par 21 Retained earnings 22 TOTAL LIABILITIES AND EQUITY 23 24 1,83,000 $ 4,15,219 $ 21,973 10,000 31,973 1,50,000 2,33,246 $ 4,15,219 25 > L 1 $ 22,500 1,30,500 30,704 48,515 2,32,219 $ 2,54,000 71,000 1 Safe Smiles Protective Masks Inc. 2 Balance Sheet 3 September 30, 2020 4 5 Assets 6 Cash 7 Accounts receivable 8 Inventory - Raw Materials 9 Inventory - Finished Goods 10 Total current assets 11 Property, plant, and equipment: 12 Less: Accumulated depreciation 13 TOTAL ASSETS 14 15 Liabilities and Equity 16 Bank loan 17 Accounts payable, purchases 18 Dividends payable 19 Total liabilities 20 Capital stock, no par 21 Retained earnings 22 TOTAL LIABILITIES AND EQUITY 23 24 1,83,000 $ 4,15,219 $ 21,973 10,000 31,973 1,50,000 2,33,246 $ 4,15,219 25 Your Task You were recently hired as an assistant controller at Safe Smiles Protective Masks Inc. ("Safe Smiles"). Your employer manufactures and sells a single product, unique and fun protective face masks for children. The masks use a special antimicrobial fabric and are well known for being extremely comfortable and durable for kids. As face masks have become the new norm during the COVID era, demand has been booming. With the return of kids to school and the upcoming cold and flu season, management expects demand to remain strong for the foreseeable future. The first task you have been assigned in your new role is to prepare the master budget for the quarter ended December 31st, 2020. You have assembled the following information. Information on sales The masks sell for $18 each. Recent and budgeted sales (in units) are as follows: August (actual) September (actual) October November December January February 7,550 8,200 7,850 8,100 8,300 7,680 7,400 All sales are on credit, with no discount. The company has found that only 30% of a month's sales are collected by month-end. An additional 50% is collected in the month following the sale, and the remaining 20% is collected in the second month following the sale. Bad debts have been negligible, so they can be ignored for the purposes of the budget. Information on inventory and production Inventories of finished goods on hand at the end of each month are to be equal to 50% of the following months budgeted sales. As of September 30th, 2020, the company had 3,925 masks in finished goods inventory. The company has no work-in-process (WIP) inventory. Each mask requires 1/10th of a yard of antimicrobial silver ion fabric, which the company purchases for $55.00 per yard. Note - both the mask and the straps are made from this same fabric so there is only one raw material used to make the product. It is company policy to keep enough fabric in raw materials to meet 70% of the next month's production needs. As of September 30th, Safe Smiles had 558 yards of fabric in raw materials inventory. Purchases of raw materials are paid for as follows: 50% in the month of nurchase and the remaining 50% in the following month inventory. The company has no work-in-process (WIP) inventory. Each mask requires 1/10th of a yard of antimicrobial silver ion fabric, which the company purchases for $55.00 per yard. Note - both the mask and the straps are made from this same fabric so there is only one raw material used to make the product. It is company policy to keep enough fabric in raw materials to meet 70% of the next month's production needs. As of September 30th, Safe Smiles had 558 yards of fabric in raw materials inventory. Purchases of raw materials are paid for as follows: 50% in the month of purchase and the remaining 50% in the following month. Each mask requires 0.25 labour hours (15 minutes) to assemble by hand. Employees who make the masks are paid $15.00 per hour, and never work overtime. The company has enough casual/on-call workers that they can call in if additional work is required. Manufacturing overhead includes all the costs of production other than direct materials and direct labour. The variable component of manufacturing overhead is $1.00 per mask in production, and the fixed component is $17,000 per month. The $17,000 of fixed manufacturing overhead includes depreciation of $2,000 per month on the sewing machines and graphic print machines used to manufacture the masks. Direct labour hours is used as an allocation base for assigning manufacturing overhead to units produced. Information on selling and administrative expenses and cash outlays Safe Smiles' other monthly operating expenses are given below: Variable: License $1.75 per mask sold ** Fixed: Wages and salaries Utilities Insurance Depreciation (S&A) Miscellaneous $10,000 $2,500 $800 $1,200 $1,000 **All masks have a print of a character popular with children. The license amount is paid directly to the companies with the exclusive rights to the characters. The Poppy Pig and Captain Sweatpants masks are expected to be the top sellers this season. All operating expenses are paid during the month in cash, with the exception of the depreciation, as it is not a cash expense. Due to the planned introduction of a new mask line for teens in 2021, the company will be purchasing a new set of industrial sewing machines in October for $23,000 and a new print machine in November for $12,000. The equipment will not be used until 2021. The machines were purchased ahead of schedule, as Safe Smiles did not want to experience any delays in case a future shutdown. The company has a policy to declare a dividend of $10,000 on the last day of each quarter, which will be paid in the first month of the next quarter. Balance Sheet of Safe Smiles Protective Masks Inc. at September 30th, 2020: Assets Cach E Additional information on cash requirements and financing Management of Safe Smiles requires a minimum ending cash balance each month of $22,000. The company can borrow money from its bank at 5% annual interest. All borrowing must be done at the beginning of a month, and repayments must be made at the end of a month. Borrowings and repayments of principal must be in round $1,000 amounts. Interest is computed and paid when any repayments occur. Round all interest payments to the nearest whole dollar. Compute interest using whole months, not days. The company wishes to use any excess cash to pay loans off as rapidly as possible. REQUIRED: Prepare the following for the company for the quarter ending December 31st: a. Sales Budget and Schedule of Expected Cash Collections b. Production Budget C. Direct Materials Budget and Schedule of Expected Cash Disbursements d. Direct Labour Budget (inclusive of expected labour disbursements) e Manufacturing Overhead Budget (inclusive of expected overhead disbursements) f. Ending Finished Goods Inventory Budget g. Selling and Administrative Budget h. Cash Budget i. Schedule of Cost of Goods Manufactured j. Budgeted Income Statement (with the cost of goods sold computation included in the income statement) You may ignore income taxes for the purposes of this budget k. Budgeted Retained Earnings Statement 1. Budgeted Balance Sheet at December 31st, 2020 Additional information on cash requirements and financing Management of Safe Smiles requires a minimum ending cash balance each month of $22,000. The company can borrow money from its bank at 5% annual interest. All borrowing must be done at the beginning of a month, and repayments must be made at the end of a month. Borrowings and repayments of principal must be in round $1,000 amounts. Interest is computed and paid when any repayments occur. Round all interest payments to the nearest whole dollar. Compute interest using whole months, not days. The company wishes to use any excess cash to pay loans off as rapidly as possible. REQUIRED: Prepare the following for the company for the quarter ending December 31st: a. Sales Budget and Schedule of Expected Cash Collections b. Production Budget C. Direct Materials Budget and Schedule of Expected Cash Disbursements d. Direct Labour Budget (inclusive of expected labour disbursements) e Manufacturing Overhead Budget (inclusive of expected overhead disbursements) f. Ending Finished Goods Inventory Budget g. Selling and Administrative Budget h. Cash Budget i. Schedule of Cost of Goods Manufactured j. Budgeted Income Statement (with the cost of goods sold computation included in the income statement) You may ignore income taxes for the purposes of this budget k. Budgeted Retained Earnings Statement 1. Budgeted Balance Sheet at December 31st, 2020 Check figures: Check figure Total cash collections for the quarter Total required production for the quarter (units) Raw materials to purchase for the quarter (total yards) Ending cash balance Total cost of goods manufactured for the quarter Total assets Amount Schedule $ 433,260 (Expected cash collections) 24,165 (Production) 2,386 (Direct materials) $33,373 (Cash budget) $298,691 (Schedule of COGM) $452,006 (Balance sheet) > L 1 $ 22,500 1,30,500 30,704 48,515 2,32,219 $ 2,54,000 71,000 1 Safe Smiles Protective Masks Inc. 2 Balance Sheet 3 September 30, 2020 4 5 Assets 6 Cash 7 Accounts receivable 8 Inventory - Raw Materials 9 Inventory - Finished Goods 10 Total current assets 11 Property, plant, and equipment: 12 Less: Accumulated depreciation 13 TOTAL ASSETS 14 15 Liabilities and Equity 16 Bank loan 17 Accounts payable, purchases 18 Dividends payable 19 Total liabilities 20 Capital stock, no par 21 Retained earnings 22 TOTAL LIABILITIES AND EQUITY 23 24 1,83,000 $ 4,15,219 $ 21,973 10,000 31,973 1,50,000 2,33,246 $ 4,15,219 25 > L 1 $ 22,500 1,30,500 30,704 48,515 2,32,219 $ 2,54,000 71,000 1 Safe Smiles Protective Masks Inc. 2 Balance Sheet 3 September 30, 2020 4 5 Assets 6 Cash 7 Accounts receivable 8 Inventory - Raw Materials 9 Inventory - Finished Goods 10 Total current assets 11 Property, plant, and equipment: 12 Less: Accumulated depreciation 13 TOTAL ASSETS 14 15 Liabilities and Equity 16 Bank loan 17 Accounts payable, purchases 18 Dividends payable 19 Total liabilities 20 Capital stock, no par 21 Retained earnings 22 TOTAL LIABILITIES AND EQUITY 23 24 1,83,000 $ 4,15,219 $ 21,973 10,000 31,973 1,50,000 2,33,246 $ 4,15,219 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts