Question: Your team is evaluating a project which approved, wil generate sales in year 2022. Your colleague estimated the following financials for you. Due to the

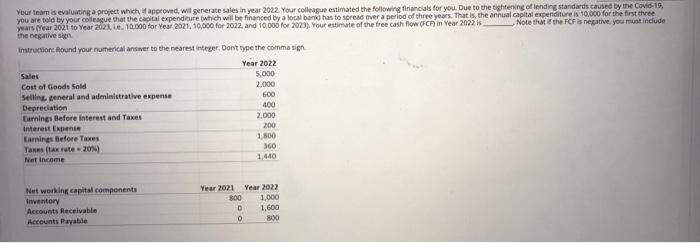

Your team is evaluating a project which approved, wil generate sales in year 2022. Your colleague estimated the following financials for you. Due to the tightening of lending standards caused by the Covid-19, you are told by your colleague that the capital expenditure which will be financed by a local bank has to spread over a period of three years. That is the annual capital expenditure is 10,000 for the first three years (Year 2021 to Year 2023, e. 10.000 for Year 2021. 10,000 for 2012 and 10,000 for 2023). Your estimate of the free cash flow (FCF) in Year 2022 Note that the FCF is negative, you must include the negative sig Instruction: Round your numerical answer to the nearest Integer Dont type the comma sign Year 2022 Sales 5.000 Cost of Goods Sold 2,000 Selling general and administrative expense 600 Depreciation Earnings Before interest and Taxes 2.000 Interest Expense 200 Earnings Before Taxes 1.800 Taxes (tax rate - 2011 360 Net Income 1,440 400 Networking capital components Inventory Accounts Receivable Accounts Payable Year 2021 Year 2022 800 1,000 0 1.600 0 RO Your team is evaluating a project which approved, wil generate sales in year 2022. Your colleague estimated the following financials for you. Due to the tightening of lending standards caused by the Covid-19, you are told by your colleague that the capital expenditure which will be financed by a local bank has to spread over a period of three years. That is the annual capital expenditure is 10,000 for the first three years (Year 2021 to Year 2023, e. 10.000 for Year 2021. 10,000 for 2012 and 10,000 for 2023). Your estimate of the free cash flow (FCF) in Year 2022 Note that the FCF is negative, you must include the negative sig Instruction: Round your numerical answer to the nearest Integer Dont type the comma sign Year 2022 Sales 5.000 Cost of Goods Sold 2,000 Selling general and administrative expense 600 Depreciation Earnings Before interest and Taxes 2.000 Interest Expense 200 Earnings Before Taxes 1.800 Taxes (tax rate - 2011 360 Net Income 1,440 400 Networking capital components Inventory Accounts Receivable Accounts Payable Year 2021 Year 2022 800 1,000 0 1.600 0 RO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts