Question: Your team's second task is to analyze discrepancies between what was planned and what actually happened. As it turns out, it appears that the previous

Your team's second task is to analyze discrepancies between what was planned and what actually happened. As it turns out, it appears that the previous management team chose to ignore their own analysis, which indicates that they are likely to have a cash shortfall during the quarter. In the end, the previous management team got lucky. They did not experience the anticipated cash flow problems. Try to analyze what "saved" them from having to take out an emergency loan. Provide a brief summary of your ideas on a separate page submitted along with the completed Cash Flow Worksheet.

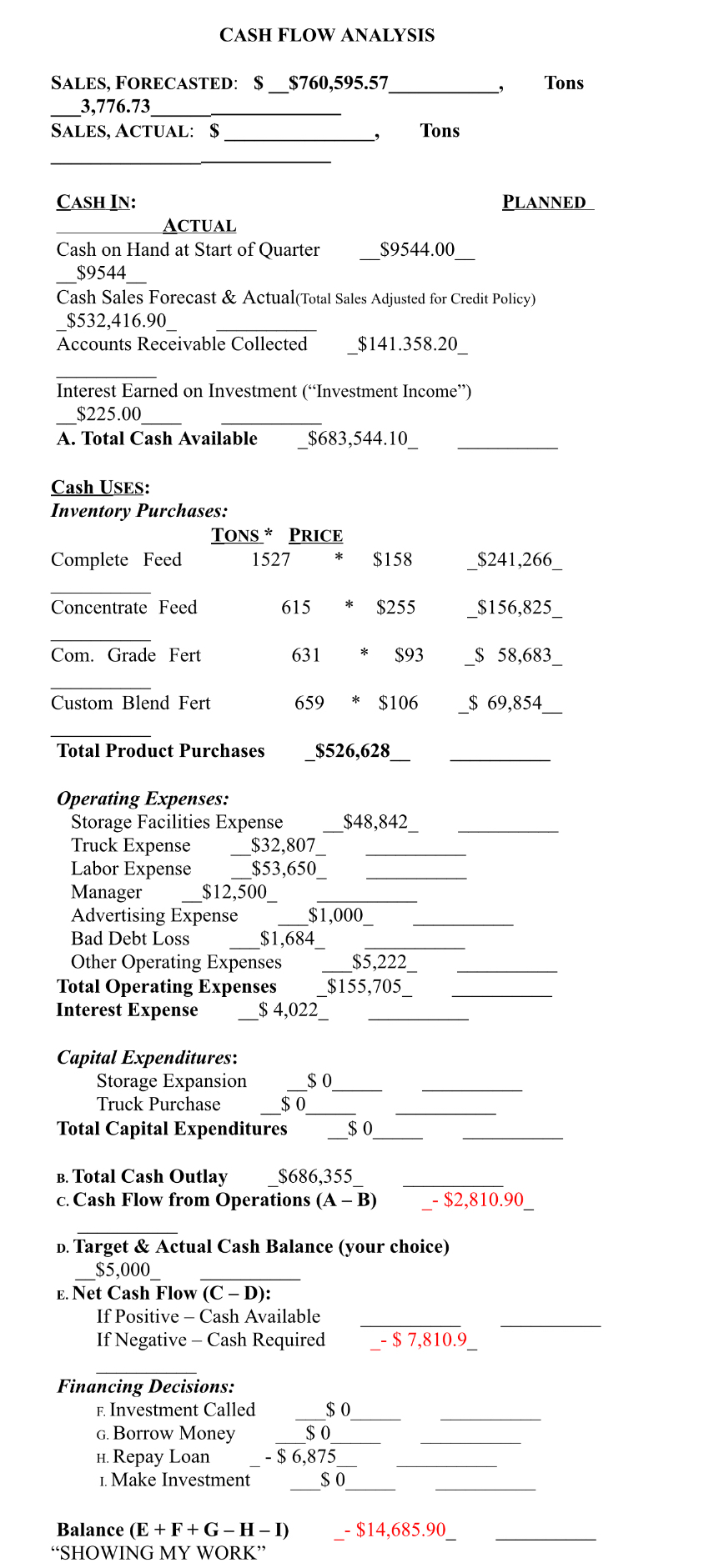

CASH FLOW ANALYSIS

SALES, FORECASTED: $$

Tons

SALES, ACTUAL: $

Tons

CASH IN:

PLANNED

ACTUAL

Cash on Hand at Start of Quarter $ $

Cash Sales Forecast & ActualTotal Sales Adjusted for Credit Policy $

Accounts Receivable Collected $

Interest Earned on Investment Investment Income" $

Cash USES:

Inventory Purchases:

B Total Cash Outlay $

c Cash Flow from Operations $

D Target & Actual Cash Balance your choice $

E Net Cash Flow Cv:

If Positive Cash Available

If Negative Cash Required

$

Financing Decisions:

F Investment Called

G Borrow Money

H Repay Loan

I. Make Investment

$

$

Balance $ "SHOWING MY WORK"

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock