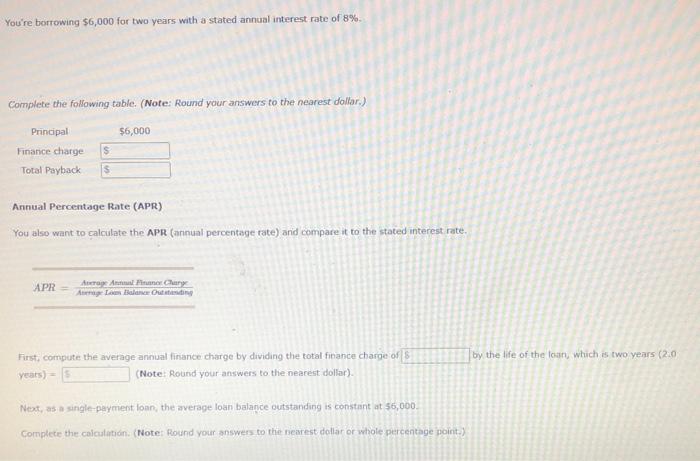

Question: You're borrowing $6,000 for two years with a stated annual interest rate of 8% Complete the following table. (Note: Round your answers to the nearest

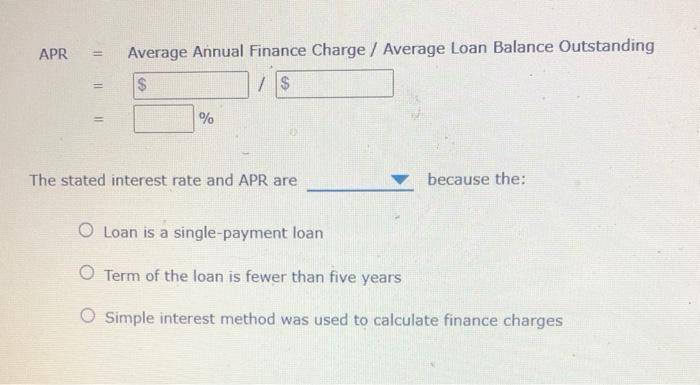

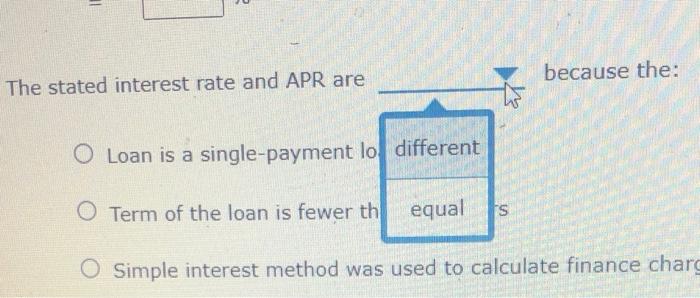

You're borrowing $6,000 for two years with a stated annual interest rate of 8% Complete the following table. (Note: Round your answers to the nearest doller.) $6,000 Principal Finance charge Total Payback Annual Percentage Rate (APR) You also want to calculate the APR (annual percentage rate) and compare it to the stated interest rate APR A Aline Chry ALEO by the life of the car, which is two years (2.0 First, compute the average annual finance charge by dividing the total finance charge of S years) (Note: Round your answers to the nearest dollar). Next, as a single paymention, the average loan balance outstanding is constant at 56,000 Complete the calculation. (Note: Round your answers to the nearest dollar or whole percentage point.) APR Average Annual Finance Charge / Average Loan Balance Outstanding = $ $ il % The stated interest rate and APR are because the: O Loan is a single-payment loan O Term of the loan is fewer than five years O Simple interest method was used to calculate finance charges 11 because the: The stated interest rate and APR are O Loan is a single-payment lo different O Term of the loan is fewer th equal S O Simple interest method was used to calculate finance charg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts