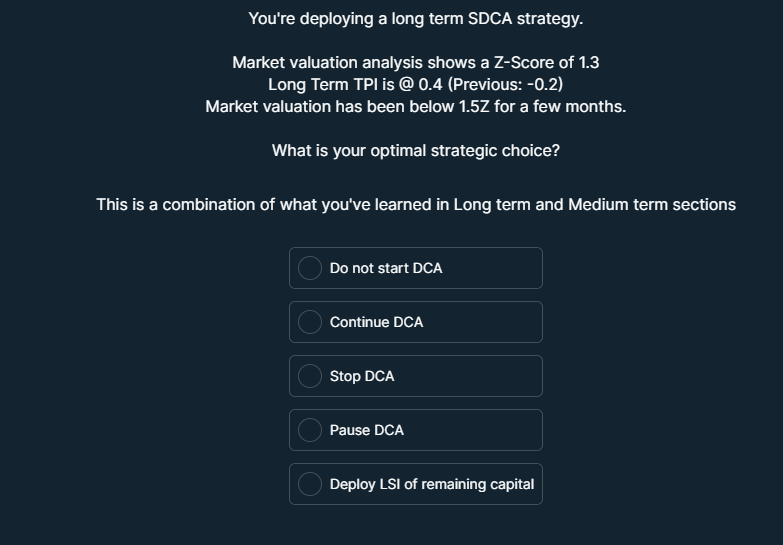

Question: You're deploying a long term SDCA strategy. Market valuation analysis shows a Z-Score of 1.3 Long Term TPI is @ 0.4 (Previous: -0.2) Market valuation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts