Question: You're evaluating a new electron microscope for the QA (quality assurance) unit. The microscope will cost $22,000 to buy and another $2,000 to install, and

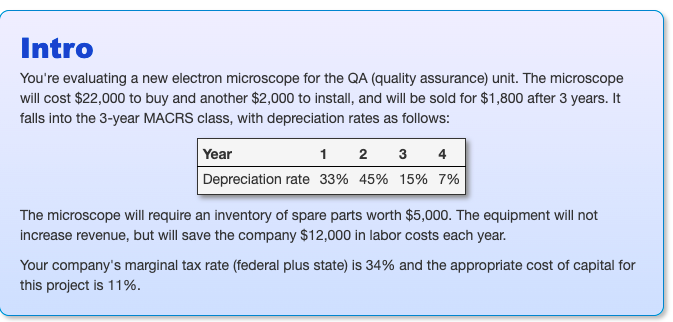

You're evaluating a new electron microscope for the QA (quality assurance) unit. The microscope will cost $22,000 to buy and another $2,000 to install, and will be sold for $1,800 after 3 years. It falls into the 3-year MACRS class, with depreciation rates as follows:

The microscope will require an inventory of spare parts worth $5,000. The equipment will not increase revenue, but will save the company $12,000 in labor costs each year.

Your company's marginal tax rate (federal plus state) is 34% and the appropriate cost of capital for this project is 11%.

What is the incremental cash flow in year 1, year 2, and year 3?

Intro You're evaluating a new electron microscope for the QA (quality assurance) unit. The microscope will cost $22,000 to buy and another $2,000 to install, and will be sold for $1,800 after 3 years. It falls into the 3-year MACRS class, with depreciation rates as follows: Year 12 3 4 Depreciation rate 33% 45% 15% 7% The microscope will require an inventory of spare parts worth $5,000. The equipment will not increase revenue, but will save the company $12,000 in labor costs each year. Your company's marginal tax rate (federal plus state) is 34% and the appropriate cost of capital for this project is 11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts