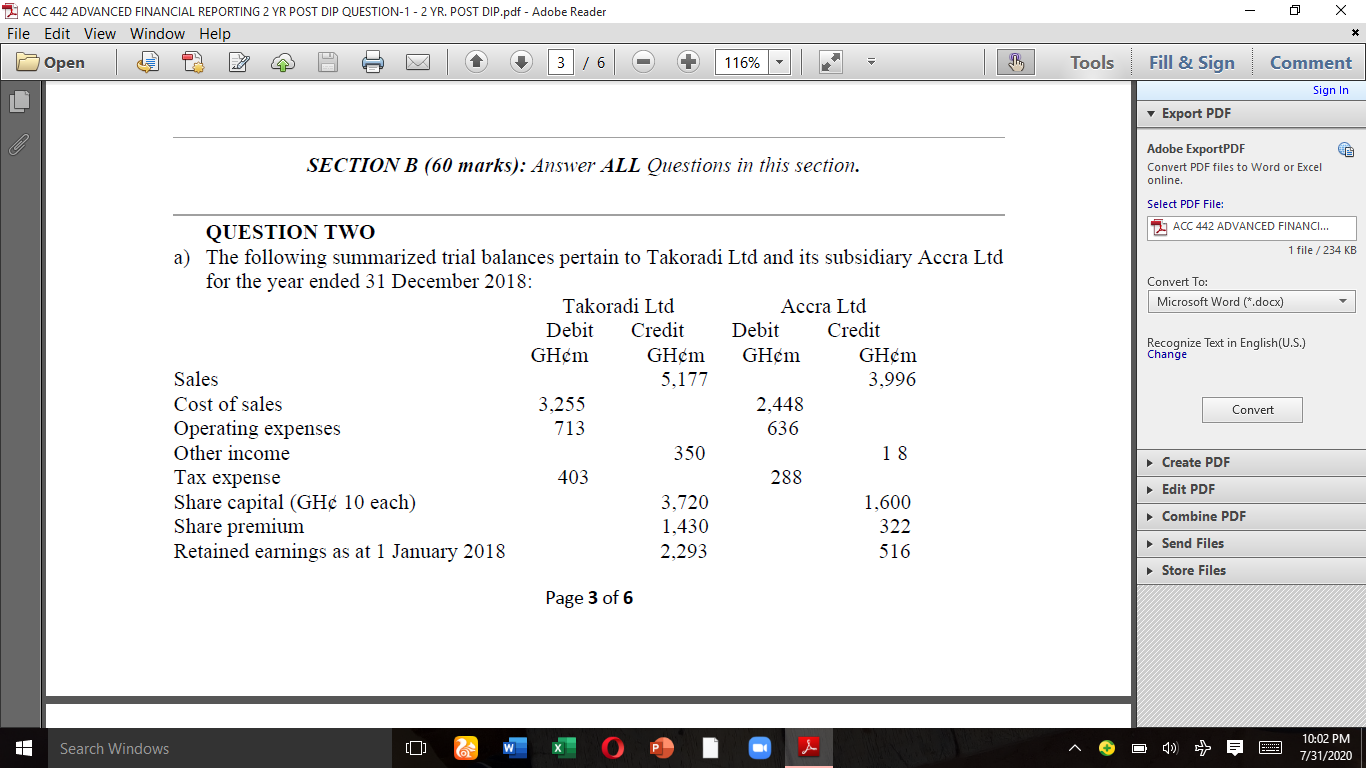

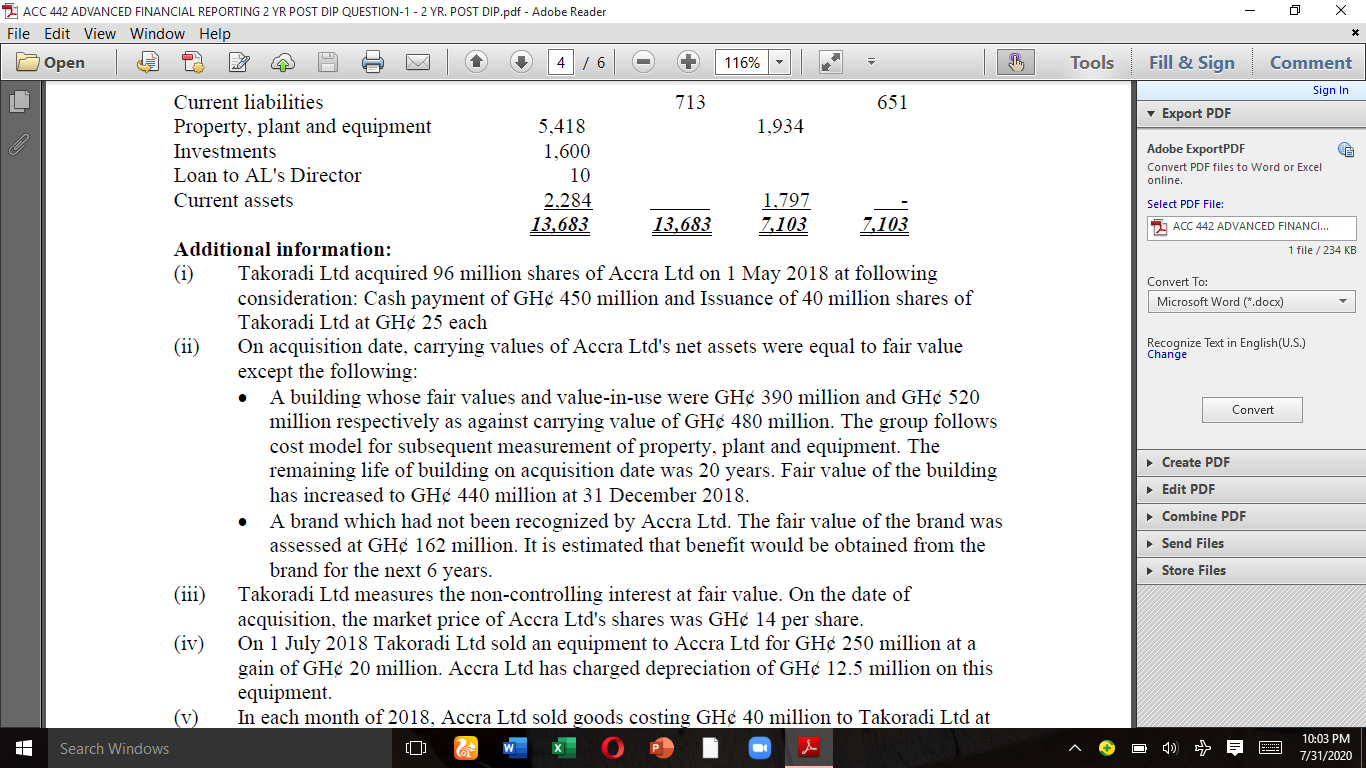

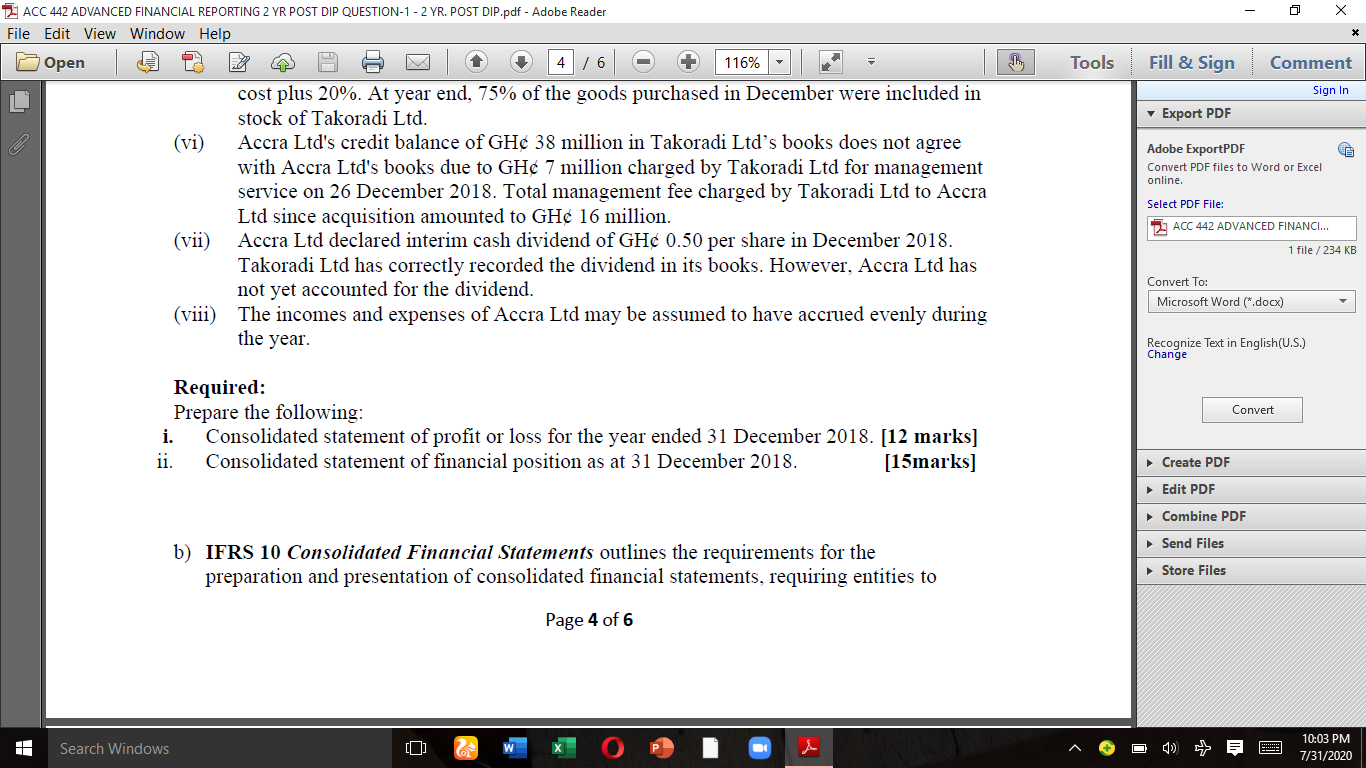

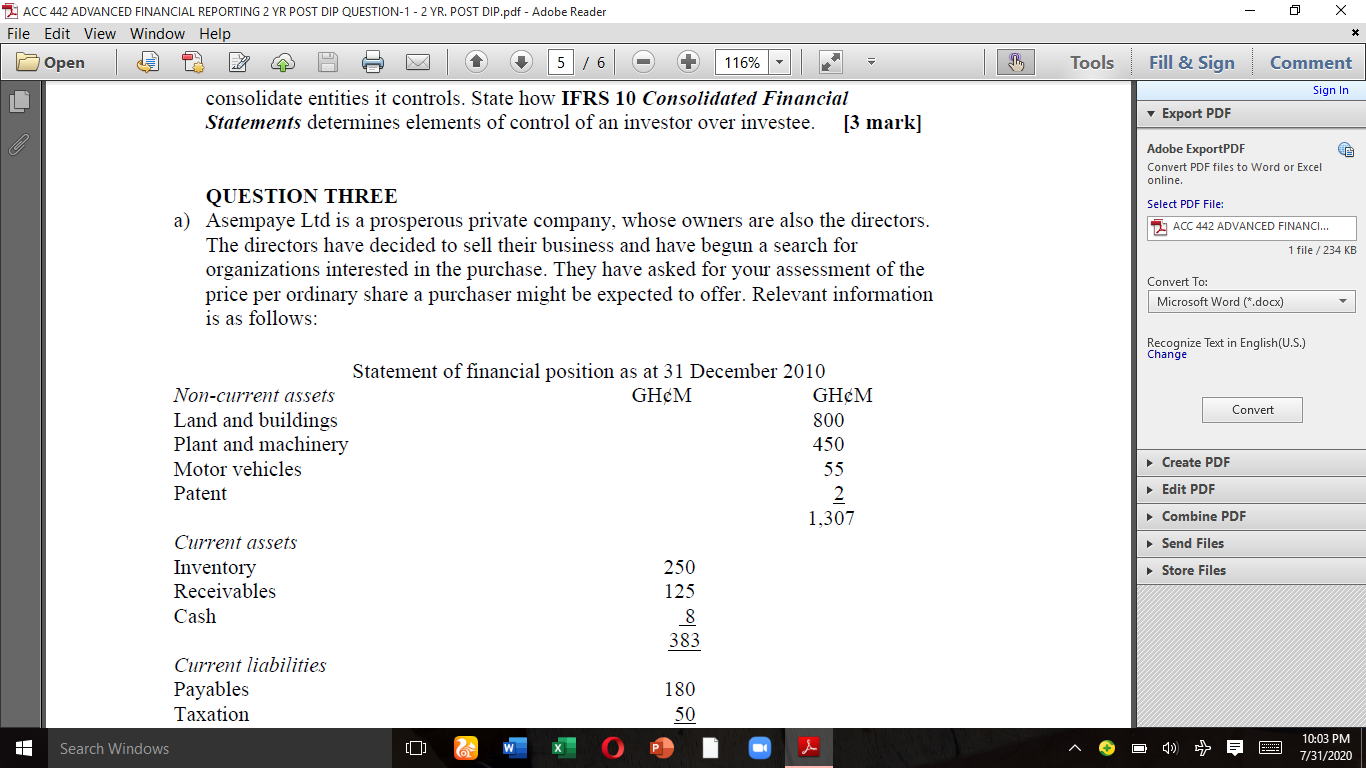

Question: Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open

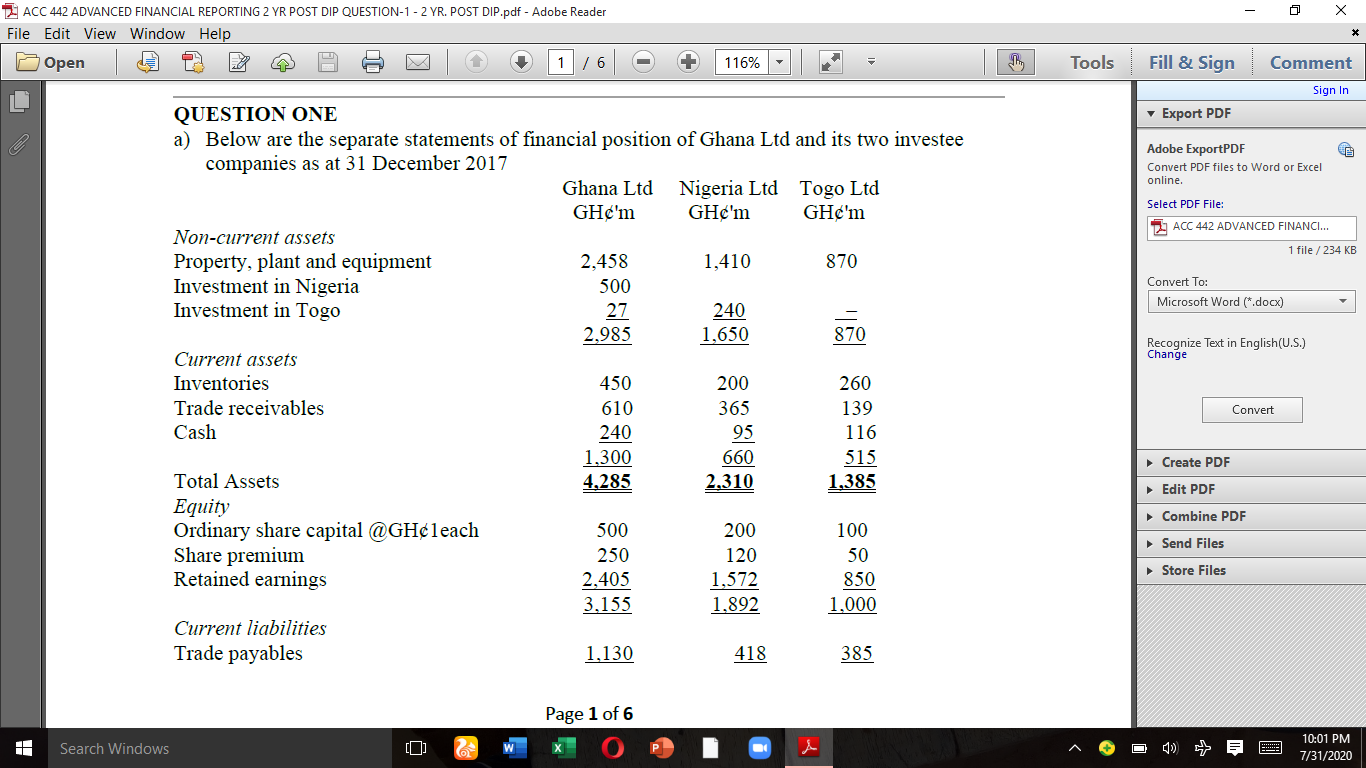

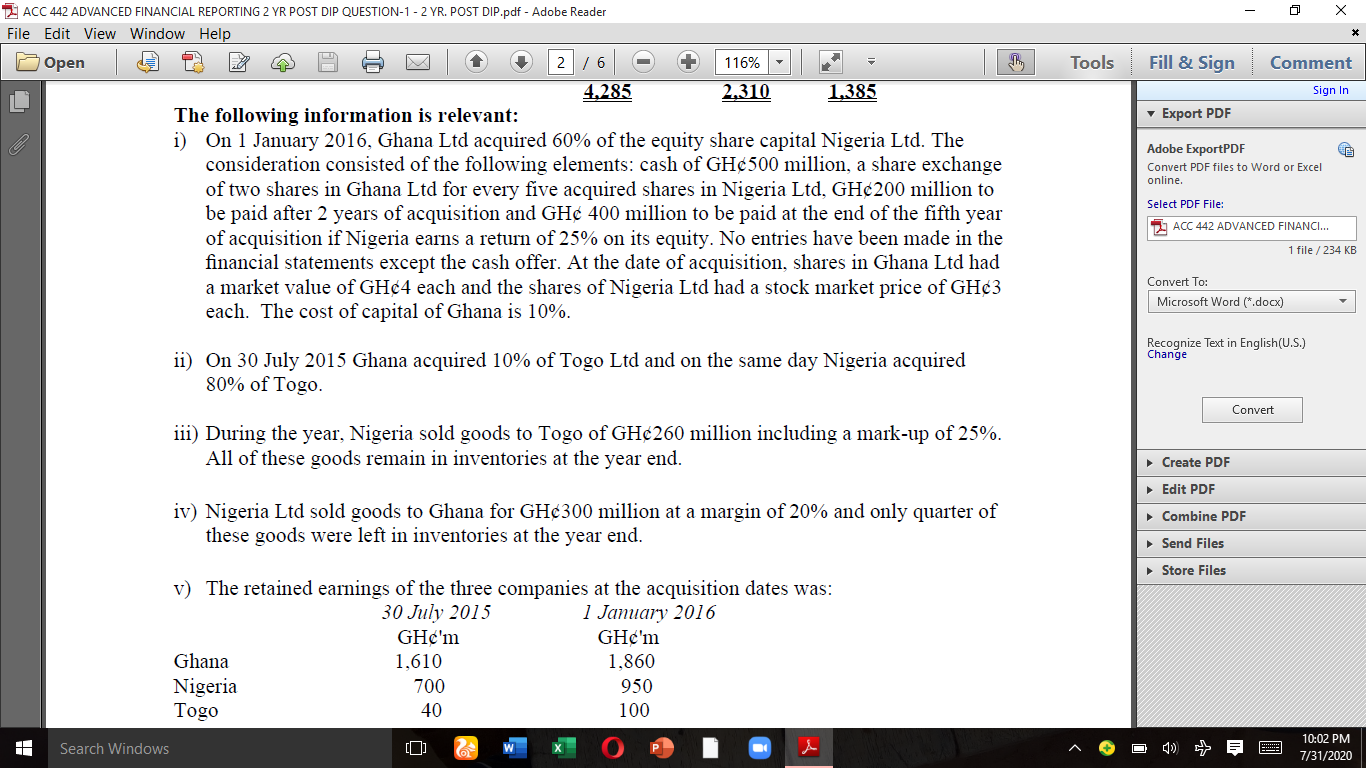

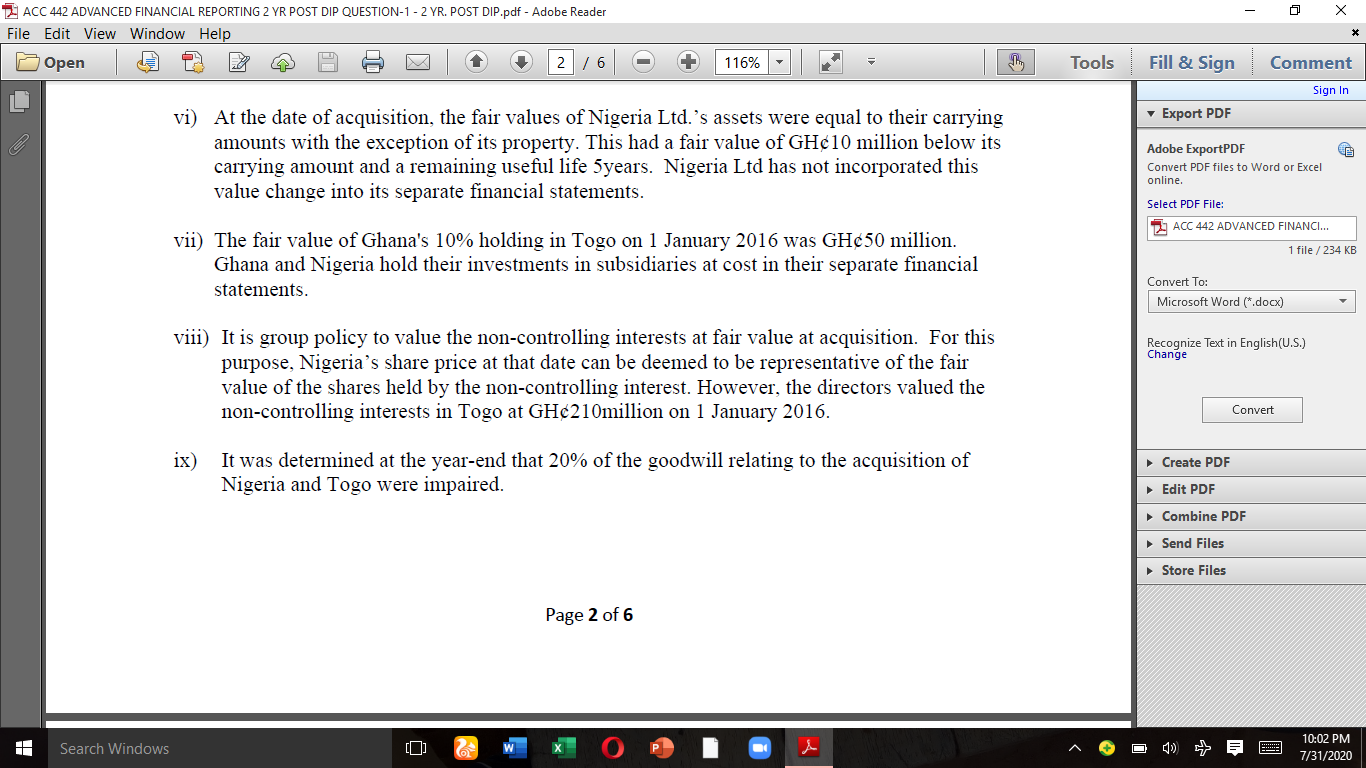

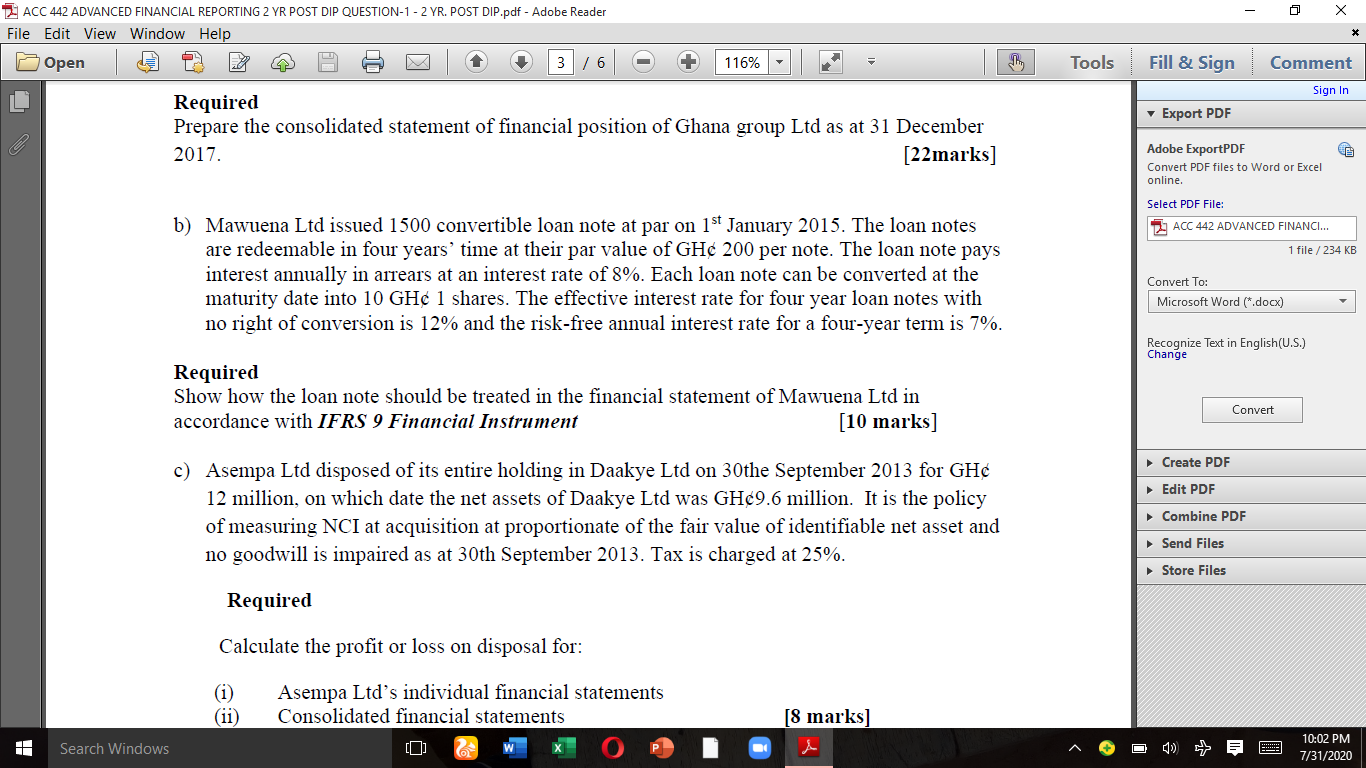

Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 1 6 116% Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change QUESTION ONE a) Below are the separate statements of financial position of Ghana Ltd and its two investee companies as at 31 December 2017 Ghana Ltd Nigeria Ltd Togo Ltd GH'm GH'm GH'm Non-current assets Property, plant and equipment 2,458 1,410 870 Investment in Nigeria 500 Investment in Togo 27 240 2,985 1,650 870 Current assets Inventories 450 200 260 Trade receivables 610 Cash 240 95 116 1.300 660 515 Total Assets 4,285 2,310 1,385 Equity Ordinary share capital @GHleach 500 200 100 Share premium 250 120 50 Retained earnings 2,405 1,572 850 3,155 1,892 1,000 Current liabilities Trade payables 1,130 418 385 365 139 Convert Crea Edit PDF Combine PDF Send Files Store Files Page 1 of 6 Search Windows d 10:01 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 2 6 116% Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. 4,285 2.310 1.385 The following information is relevant: i) On 1 January 2016, Ghana Ltd acquired 60% of the equity share capital Nigeria Ltd. The consideration consisted of the following elements: cash of GH500 million, a share exchange of two shares in Ghana Ltd for every five acquired shares in Nigeria Ltd, GH200 million to be paid after 2 years of acquisition and GH 400 million to be paid at the end of the fifth year of acquisition if Nigeria earns a return of 25% on its equity. No entries have been made in the financial statements except the cash offer. At the date of acquisition, shares in Ghana Ltd had a market value of GH4 each and the shares of Nigeria Ltd had a stock market price of GH3 each. The cost of capital of Ghana is 10%. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change ii) On 30 July 2015 Ghana acquired 10% of Togo Ltd and on the same day Nigeria acquired 80% of Togo. Convert 111) During the year, Nigeria sold goods to Togo of GH260 million including a mark-up of 25%. All of these goods remain in inventories at the year end. Crea Edit PDF iv) Nigeria Ltd sold goods to Ghana for GH300 million at a margin of 20% and only quarter of these goods were left in inventories at the year end. Combine PDF Send Files Store Files v) The retained earnings of the three companies at the acquisition dates was: 30 July 2015 1 January 2016 GHe'm GHe'm Ghana 1,610 1,860 Nigeria 700 950 Togo 40 100 Search Windows d 10:02 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 2 6 116% Tools Fill & Sign Comment Sign In Export PDF vi) At the date of acquisition, the fair values of Nigeria Ltd. 's assets were equal to their carrying amounts with the exception of its property. This had a fair value of GH10 million below its carrying amount and a remaining useful life 5years. Nigeria Ltd has not incorporated this value change into its separate financial statements. Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB vii) The fair value of Ghana's 10% holding in Togo on 1 January 2016 was GH50 million. Ghana and Nigeria hold their investments in subsidiaries at cost in their separate financial statements. Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change viii) It is group policy to value the non-controlling interests at fair value at acquisition. For this purpose, Nigeria's share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. However, the directors valued the non-controlling interests in Togo at GH210million on 1 January 2016. Convert ix) Crea It was determined at the year-end that 20% of the goodwill relating to the acquisition of Nigeria and Togo were impaired. Edit PDF Combine PDF Send Files Store Files Page 2 of 6 Search Windows 10:02 PM 7/31/2020 ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 3 6 116% Tools Fill & Sign Comment Sign In Export PDF Required Prepare the consolidated statement of financial position of Ghana group Ltd as at 31 December 2017. [22 marks] Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB b) Mawuena Ltd issued 1500 convertible loan note at par on 1st January 2015. The loan notes are redeemable in four years' time at their par value of GH 200 per note. The loan note pays interest annually in arrears at an interest rate of 8%. Each loan note can be converted at the maturity date into 10 GH 1 shares. The effective interest rate for four year loan notes with no right of conversion is 12% and the risk-free annual interest rate for a four-year term is 7%. Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Required Show how the loan note should be treated in the financial statement of Mawuena Ltd in accordance with IFRS 9 Financial Instrument [10 marks] Convert Crea Edit PDF c) Asempa Ltd disposed of its entire holding in Daakye Ltd on 30the September 2013 for GH 12 million, on which date the net assets of Daakye Ltd was GH9.6 million. It is the policy of measuring NCI at acquisition at proportionate of the fair value of identifiable net asset and no goodwill is impaired as at 30th September 2013. Tax is charged at 25%. Combine PDF Send Files Store Files Required Calculate the profit or loss on disposal for: Asempa Ltd's individual financial statements Consolidated financial statements [8 marks] d Search Windows 10:02 PM 7/31/2020 ZACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 3 6 116% Tools Fill & Sign Comment Sign In Export PDF SECTION B (60 marks): Answer ALL Questions in this section. Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change QUESTION TWO a) The following summarized trial balances pertain to Takoradi Ltd and its subsidiary Accra Ltd for the year ended 31 December 2018: Takoradi Ltd Accra Ltd Debit Credit Debit Credit GHem GHm GHm GHem Sales 5.177 3.996 Cost of sales 3,255 2.448 Operating expenses 713 636 Other income 350 18 288 Share capital (GHC 10 each) 3,720 Share premium 1,430 322 Retained earnings as at 1 January 2018 2.293 516 Convert Crea Tax expense 403 Edit PDF 1,600 Combine PDF Send Files Store Files Page 3 of 6 1 Search Windows d 10:02 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 4 6 116% Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Convert Current liabilities 713 651 Property, plant and equipment 5,418 1.934 Investments 1,600 Loan to AL's Director 10 Current assets 2.284 1,797 13,683 13,683 7,103 7,103 Additional information: Takoradi Ltd acquired 96 million shares of Accra Ltd on 1 May 2018 at following consideration: Cash payment of GH 450 million and Issuance of 40 million shares of Takoradi Ltd at GH 25 each (ii) On acquisition date, carrying values of Accra Ltd's net assets were equal to fair value except the following: A building whose fair values and value-in-use were GH 390 million and GH 520 million respectively as against carrying value of GH 480 million. The group follows cost model for subsequent measurement of property, plant and equipment. The remaining life of building on acquisition date was 20 years. Fair value of the building has increased to GH 440 million at 31 December 2018. A brand which had not been recognized by Accra Ltd. The fair value of the brand was assessed at GH 162 million. It is estimated that benefit would be obtained from the brand for the next 6 years. (111) Takoradi Ltd measures the non-controlling interest at fair value. On the date of acquisition, the market price of Accra Ltd's shares was GH 14 per share. (iv) On 1 July 2018 Takoradi Ltd sold an equipment to Accra Ltd for GH 250 million at a gain of GH 20 million. Accra Ltd has charged depreciation of GH 12.5 million on this equipment. In each month of 2018, Accra Ltd sold goods costing GH 40 million to Takoradi Ltd at Search Windows Crea Edit PDF Combine PDF Send Files Store Files 10:03 PM 7/31/2020 Tools Fill & Sign Comment Sign In Export PDF Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 4 6 + 116% cost plus 20%. At year end, 75% of the goods purchased in December were included in stock of Takoradi Ltd. (vi) Accra Ltd's credit balance of GH 38 million in Takoradi Ltd's books does not agree with Accra Ltd's books due to GH 7 million charged by Takoradi Ltd for management service on 26 December 2018. Total management fee charged by Takoradi Ltd to Accra Ltd since acquisition amounted to GH 16 million. (vii) Accra Ltd declared interim cash dividend of GH 0.50 per share in December 2018. Takoradi Ltd has correctly recorded the dividend in its books. However, Accra Ltd has not yet accounted for the dividend. (viii) The incomes and expenses of Accra Ltd may be assumed to have accrued evenly during Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) the year Recognize Text in English (U.S.) Change Convert Required: Prepare the following: i. Consolidated statement of profit or loss for the year ended 31 December 2018. [12 marks] ii. Consolidated statement of financial position as at 31 December 2018. rks] Crea Edit PDF Combine PDF Send Files b) IFRS 10 Consolidated Financial Statements outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to Store Files Page 4 of 6 Search Windows 10:03 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 2 5 6 116% consolidate entities it controls. State how IFRS 10 Consolidated Financial Statements determines elements of control of an investor over investee. [3 mark] Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB QUESTION THREE a) Asempaye Ltd is a prosperous private company, whose owners are also the directors. The directors have decided to sell their business and have begun a search for organizations interested in the purchase. They have asked for your assessment of the price per ordinary share a purchaser might be expected to offer. Relevant information is as follows: Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Convert Crea Edit PDF Combine PDF Statement of financial position as at 31 December 2010 Non-current assets GHCM GHCM Land and buildings 800 Plant and machinery 450 Motor vehicles 55 Patent 2 1,307 Current assets Inventory 250 Receivables 125 Cash 8 383 Current liabilities Payables 180 Taxation 50 Send Files Store Files Search Windows 10:03 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 5 6 116% Tools Fill & Sign Comment 230 Sign In Export PDF Net current asset Loan secured on property 153 (400) 1.060 Adobe Export PDF Convert PDF files to Word or Excel online. Ordinary shares (300,000) Reserves 300 760 1,060 Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Profits after tax and interest but before dividend over the past 5 years were as follows: Year GHCM 2004 80 2005 78 2006 87 2007 95 2008 100 Convert Crea Edit PDF Combine PDF The annual dividend has been GH45 million for the last six years. The company's five years plan forecast an after tax profit of GH100 million for the next12 months with an increase of 4% a year over reach of the next 4 years. Send Files Store Files Page 5 of 6 Search Windows 10:03 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 1 6 / 6 116% Tools Fill & Sign Comment Sign In Export PDF As part of their preparations to sell the company, the directors have had their current assets revalued by an independent expert with the following results: GHC Land and buildings 1,075 Plant and machinery 480 Motor vehicles 45 Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change The dividend yields and the P/E ratios of three quoted companies in the same industry as Asempaye over the last years have been as follows: Asaaba Ltd Pasaah Ltd Arthur Ltd D/Y P/E D/Y P/E D/Y P/E % % % 2010 12.0 8.5 11.0 9.0 13.0 10.0 1999 12.0 8.0 10.6 8.5 12.6 9.5 1998 12.0 8.5 9.3 8.0 12.4 9.0 Averages 12.0 8.33 10.3 8.5 12.7 9.5 Convert Crea Edit PDF Combine PDF Send Files Large companies in the industry apply an after-tax cost of capital of about 18% to acquisition proposal when the investment is not backed by tangible assets, as opposed to a rare of 14% on the net tangible assets. Store Files Your assessment of the net cash flow which will accrue to a purchasing company, allowing for taxation and capital expenditure for a target five year period is as follows: Year Cash flow GH Search Windows 10:04 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 6 6 116% Tools Fill & Sign Comment Sign In 1 Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. GHC 120 2 120 3 140 4 70 5 120 Required: Use the information provided to suggest six (6) Valuations which prospective purchasers might make. (Assume that the risk associated with lack of marketability of Asempaye Ltd is 20%) [22 marks] Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change b) State five (5) reasons for valuing a business [5marks) c) State three (3) factors to consider when making a decision on functional currency [3 marks] Convert Crea Edit PDF Combine PDF Send Files Store Files Page 6 of 6 Search Windows d 10:04 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 1 6 116% Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change QUESTION ONE a) Below are the separate statements of financial position of Ghana Ltd and its two investee companies as at 31 December 2017 Ghana Ltd Nigeria Ltd Togo Ltd GH'm GH'm GH'm Non-current assets Property, plant and equipment 2,458 1,410 870 Investment in Nigeria 500 Investment in Togo 27 240 2,985 1,650 870 Current assets Inventories 450 200 260 Trade receivables 610 Cash 240 95 116 1.300 660 515 Total Assets 4,285 2,310 1,385 Equity Ordinary share capital @GHleach 500 200 100 Share premium 250 120 50 Retained earnings 2,405 1,572 850 3,155 1,892 1,000 Current liabilities Trade payables 1,130 418 385 365 139 Convert Crea Edit PDF Combine PDF Send Files Store Files Page 1 of 6 Search Windows d 10:01 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 2 6 116% Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. 4,285 2.310 1.385 The following information is relevant: i) On 1 January 2016, Ghana Ltd acquired 60% of the equity share capital Nigeria Ltd. The consideration consisted of the following elements: cash of GH500 million, a share exchange of two shares in Ghana Ltd for every five acquired shares in Nigeria Ltd, GH200 million to be paid after 2 years of acquisition and GH 400 million to be paid at the end of the fifth year of acquisition if Nigeria earns a return of 25% on its equity. No entries have been made in the financial statements except the cash offer. At the date of acquisition, shares in Ghana Ltd had a market value of GH4 each and the shares of Nigeria Ltd had a stock market price of GH3 each. The cost of capital of Ghana is 10%. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change ii) On 30 July 2015 Ghana acquired 10% of Togo Ltd and on the same day Nigeria acquired 80% of Togo. Convert 111) During the year, Nigeria sold goods to Togo of GH260 million including a mark-up of 25%. All of these goods remain in inventories at the year end. Crea Edit PDF iv) Nigeria Ltd sold goods to Ghana for GH300 million at a margin of 20% and only quarter of these goods were left in inventories at the year end. Combine PDF Send Files Store Files v) The retained earnings of the three companies at the acquisition dates was: 30 July 2015 1 January 2016 GHe'm GHe'm Ghana 1,610 1,860 Nigeria 700 950 Togo 40 100 Search Windows d 10:02 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 2 6 116% Tools Fill & Sign Comment Sign In Export PDF vi) At the date of acquisition, the fair values of Nigeria Ltd. 's assets were equal to their carrying amounts with the exception of its property. This had a fair value of GH10 million below its carrying amount and a remaining useful life 5years. Nigeria Ltd has not incorporated this value change into its separate financial statements. Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB vii) The fair value of Ghana's 10% holding in Togo on 1 January 2016 was GH50 million. Ghana and Nigeria hold their investments in subsidiaries at cost in their separate financial statements. Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change viii) It is group policy to value the non-controlling interests at fair value at acquisition. For this purpose, Nigeria's share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. However, the directors valued the non-controlling interests in Togo at GH210million on 1 January 2016. Convert ix) Crea It was determined at the year-end that 20% of the goodwill relating to the acquisition of Nigeria and Togo were impaired. Edit PDF Combine PDF Send Files Store Files Page 2 of 6 Search Windows 10:02 PM 7/31/2020 ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 3 6 116% Tools Fill & Sign Comment Sign In Export PDF Required Prepare the consolidated statement of financial position of Ghana group Ltd as at 31 December 2017. [22 marks] Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB b) Mawuena Ltd issued 1500 convertible loan note at par on 1st January 2015. The loan notes are redeemable in four years' time at their par value of GH 200 per note. The loan note pays interest annually in arrears at an interest rate of 8%. Each loan note can be converted at the maturity date into 10 GH 1 shares. The effective interest rate for four year loan notes with no right of conversion is 12% and the risk-free annual interest rate for a four-year term is 7%. Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Required Show how the loan note should be treated in the financial statement of Mawuena Ltd in accordance with IFRS 9 Financial Instrument [10 marks] Convert Crea Edit PDF c) Asempa Ltd disposed of its entire holding in Daakye Ltd on 30the September 2013 for GH 12 million, on which date the net assets of Daakye Ltd was GH9.6 million. It is the policy of measuring NCI at acquisition at proportionate of the fair value of identifiable net asset and no goodwill is impaired as at 30th September 2013. Tax is charged at 25%. Combine PDF Send Files Store Files Required Calculate the profit or loss on disposal for: Asempa Ltd's individual financial statements Consolidated financial statements [8 marks] d Search Windows 10:02 PM 7/31/2020 ZACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 3 6 116% Tools Fill & Sign Comment Sign In Export PDF SECTION B (60 marks): Answer ALL Questions in this section. Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change QUESTION TWO a) The following summarized trial balances pertain to Takoradi Ltd and its subsidiary Accra Ltd for the year ended 31 December 2018: Takoradi Ltd Accra Ltd Debit Credit Debit Credit GHem GHm GHm GHem Sales 5.177 3.996 Cost of sales 3,255 2.448 Operating expenses 713 636 Other income 350 18 288 Share capital (GHC 10 each) 3,720 Share premium 1,430 322 Retained earnings as at 1 January 2018 2.293 516 Convert Crea Tax expense 403 Edit PDF 1,600 Combine PDF Send Files Store Files Page 3 of 6 1 Search Windows d 10:02 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 4 6 116% Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Convert Current liabilities 713 651 Property, plant and equipment 5,418 1.934 Investments 1,600 Loan to AL's Director 10 Current assets 2.284 1,797 13,683 13,683 7,103 7,103 Additional information: Takoradi Ltd acquired 96 million shares of Accra Ltd on 1 May 2018 at following consideration: Cash payment of GH 450 million and Issuance of 40 million shares of Takoradi Ltd at GH 25 each (ii) On acquisition date, carrying values of Accra Ltd's net assets were equal to fair value except the following: A building whose fair values and value-in-use were GH 390 million and GH 520 million respectively as against carrying value of GH 480 million. The group follows cost model for subsequent measurement of property, plant and equipment. The remaining life of building on acquisition date was 20 years. Fair value of the building has increased to GH 440 million at 31 December 2018. A brand which had not been recognized by Accra Ltd. The fair value of the brand was assessed at GH 162 million. It is estimated that benefit would be obtained from the brand for the next 6 years. (111) Takoradi Ltd measures the non-controlling interest at fair value. On the date of acquisition, the market price of Accra Ltd's shares was GH 14 per share. (iv) On 1 July 2018 Takoradi Ltd sold an equipment to Accra Ltd for GH 250 million at a gain of GH 20 million. Accra Ltd has charged depreciation of GH 12.5 million on this equipment. In each month of 2018, Accra Ltd sold goods costing GH 40 million to Takoradi Ltd at Search Windows Crea Edit PDF Combine PDF Send Files Store Files 10:03 PM 7/31/2020 Tools Fill & Sign Comment Sign In Export PDF Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 4 6 + 116% cost plus 20%. At year end, 75% of the goods purchased in December were included in stock of Takoradi Ltd. (vi) Accra Ltd's credit balance of GH 38 million in Takoradi Ltd's books does not agree with Accra Ltd's books due to GH 7 million charged by Takoradi Ltd for management service on 26 December 2018. Total management fee charged by Takoradi Ltd to Accra Ltd since acquisition amounted to GH 16 million. (vii) Accra Ltd declared interim cash dividend of GH 0.50 per share in December 2018. Takoradi Ltd has correctly recorded the dividend in its books. However, Accra Ltd has not yet accounted for the dividend. (viii) The incomes and expenses of Accra Ltd may be assumed to have accrued evenly during Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) the year Recognize Text in English (U.S.) Change Convert Required: Prepare the following: i. Consolidated statement of profit or loss for the year ended 31 December 2018. [12 marks] ii. Consolidated statement of financial position as at 31 December 2018. rks] Crea Edit PDF Combine PDF Send Files b) IFRS 10 Consolidated Financial Statements outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to Store Files Page 4 of 6 Search Windows 10:03 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 2 5 6 116% consolidate entities it controls. State how IFRS 10 Consolidated Financial Statements determines elements of control of an investor over investee. [3 mark] Tools Fill & Sign Comment Sign In Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB QUESTION THREE a) Asempaye Ltd is a prosperous private company, whose owners are also the directors. The directors have decided to sell their business and have begun a search for organizations interested in the purchase. They have asked for your assessment of the price per ordinary share a purchaser might be expected to offer. Relevant information is as follows: Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Convert Crea Edit PDF Combine PDF Statement of financial position as at 31 December 2010 Non-current assets GHCM GHCM Land and buildings 800 Plant and machinery 450 Motor vehicles 55 Patent 2 1,307 Current assets Inventory 250 Receivables 125 Cash 8 383 Current liabilities Payables 180 Taxation 50 Send Files Store Files Search Windows 10:03 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 5 6 116% Tools Fill & Sign Comment 230 Sign In Export PDF Net current asset Loan secured on property 153 (400) 1.060 Adobe Export PDF Convert PDF files to Word or Excel online. Ordinary shares (300,000) Reserves 300 760 1,060 Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change Profits after tax and interest but before dividend over the past 5 years were as follows: Year GHCM 2004 80 2005 78 2006 87 2007 95 2008 100 Convert Crea Edit PDF Combine PDF The annual dividend has been GH45 million for the last six years. The company's five years plan forecast an after tax profit of GH100 million for the next12 months with an increase of 4% a year over reach of the next 4 years. Send Files Store Files Page 5 of 6 Search Windows 10:03 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 1 6 / 6 116% Tools Fill & Sign Comment Sign In Export PDF As part of their preparations to sell the company, the directors have had their current assets revalued by an independent expert with the following results: GHC Land and buildings 1,075 Plant and machinery 480 Motor vehicles 45 Adobe Export PDF Convert PDF files to Word or Excel online. Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change The dividend yields and the P/E ratios of three quoted companies in the same industry as Asempaye over the last years have been as follows: Asaaba Ltd Pasaah Ltd Arthur Ltd D/Y P/E D/Y P/E D/Y P/E % % % 2010 12.0 8.5 11.0 9.0 13.0 10.0 1999 12.0 8.0 10.6 8.5 12.6 9.5 1998 12.0 8.5 9.3 8.0 12.4 9.0 Averages 12.0 8.33 10.3 8.5 12.7 9.5 Convert Crea Edit PDF Combine PDF Send Files Large companies in the industry apply an after-tax cost of capital of about 18% to acquisition proposal when the investment is not backed by tangible assets, as opposed to a rare of 14% on the net tangible assets. Store Files Your assessment of the net cash flow which will accrue to a purchasing company, allowing for taxation and capital expenditure for a target five year period is as follows: Year Cash flow GH Search Windows 10:04 PM 7/31/2020 Z ACC 442 ADVANCED FINANCIAL REPORTING 2 YR POST DIP QUESTION-1 - 2 YR. POST DIP.pdf - Adobe Reader File Edit View Window Help Open 6 6 116% Tools Fill & Sign Comment Sign In 1 Export PDF Adobe Export PDF Convert PDF files to Word or Excel online. GHC 120 2 120 3 140 4 70 5 120 Required: Use the information provided to suggest six (6) Valuations which prospective purchasers might make. (Assume that the risk associated with lack of marketability of Asempaye Ltd is 20%) [22 marks] Select PDF File: ACC 442 ADVANCED FINANCI... 1 file/234 KB Convert To: Microsoft Word (*.docx) Recognize Text in English (U.S.) Change b) State five (5) reasons for valuing a business [5marks) c) State three (3) factors to consider when making a decision on functional currency [3 marks] Convert Crea Edit PDF Combine PDF Send Files Store Files Page 6 of 6 Search Windows d 10:04 PM 7/31/2020

Step by Step Solution

There are 3 Steps involved in it

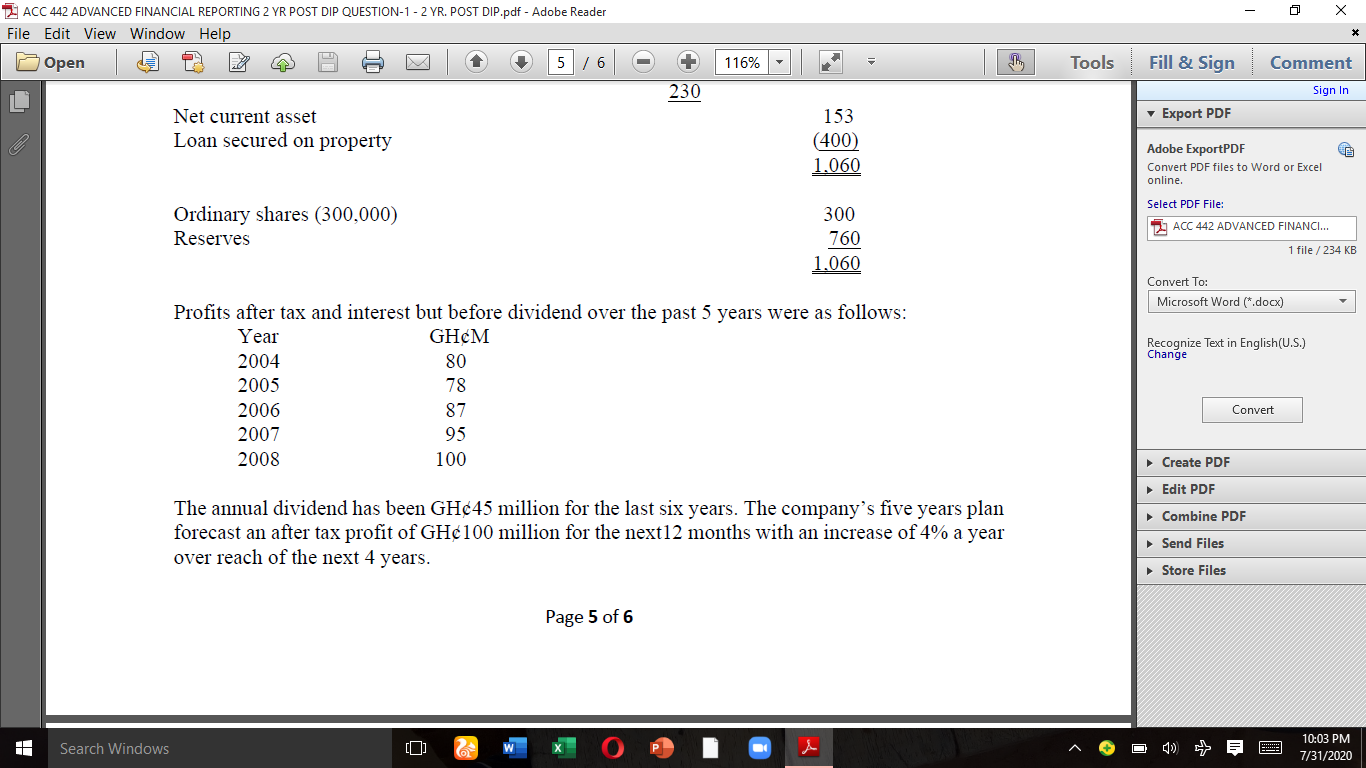

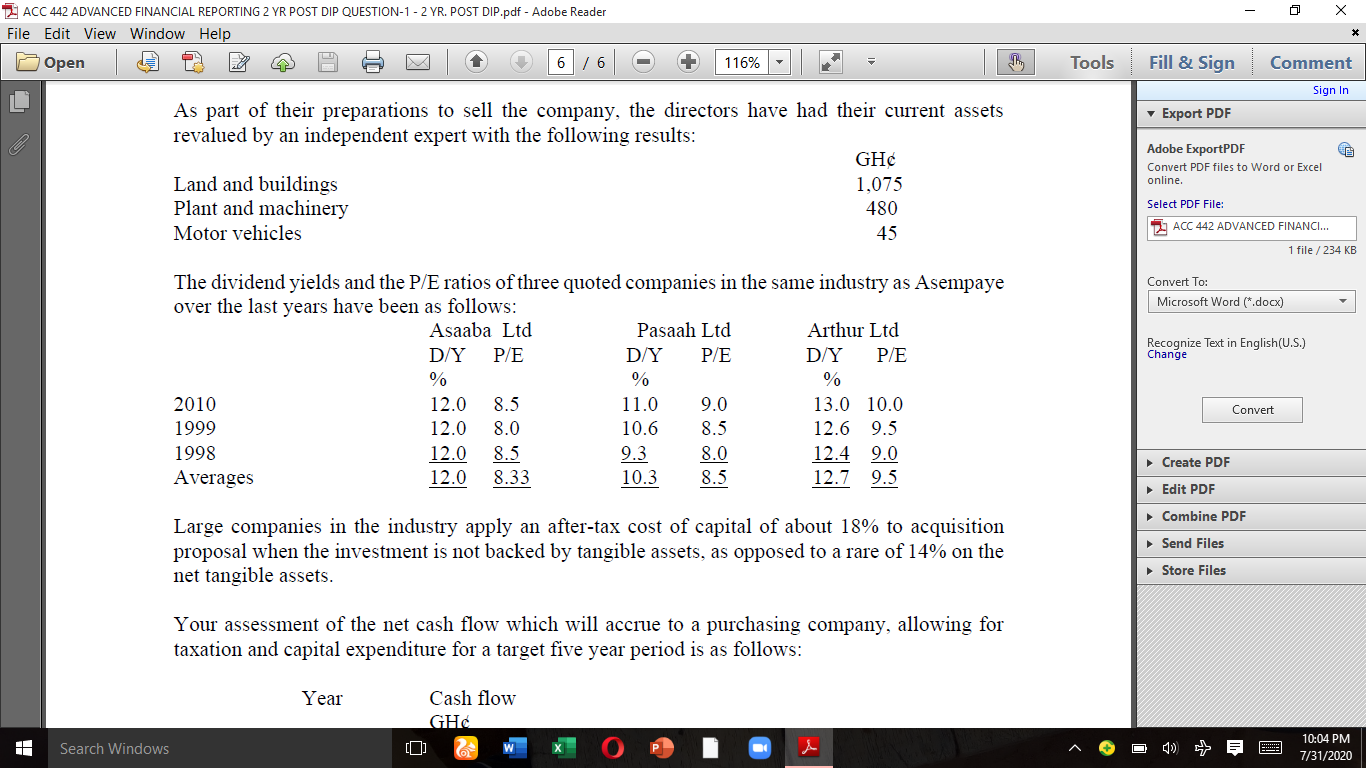

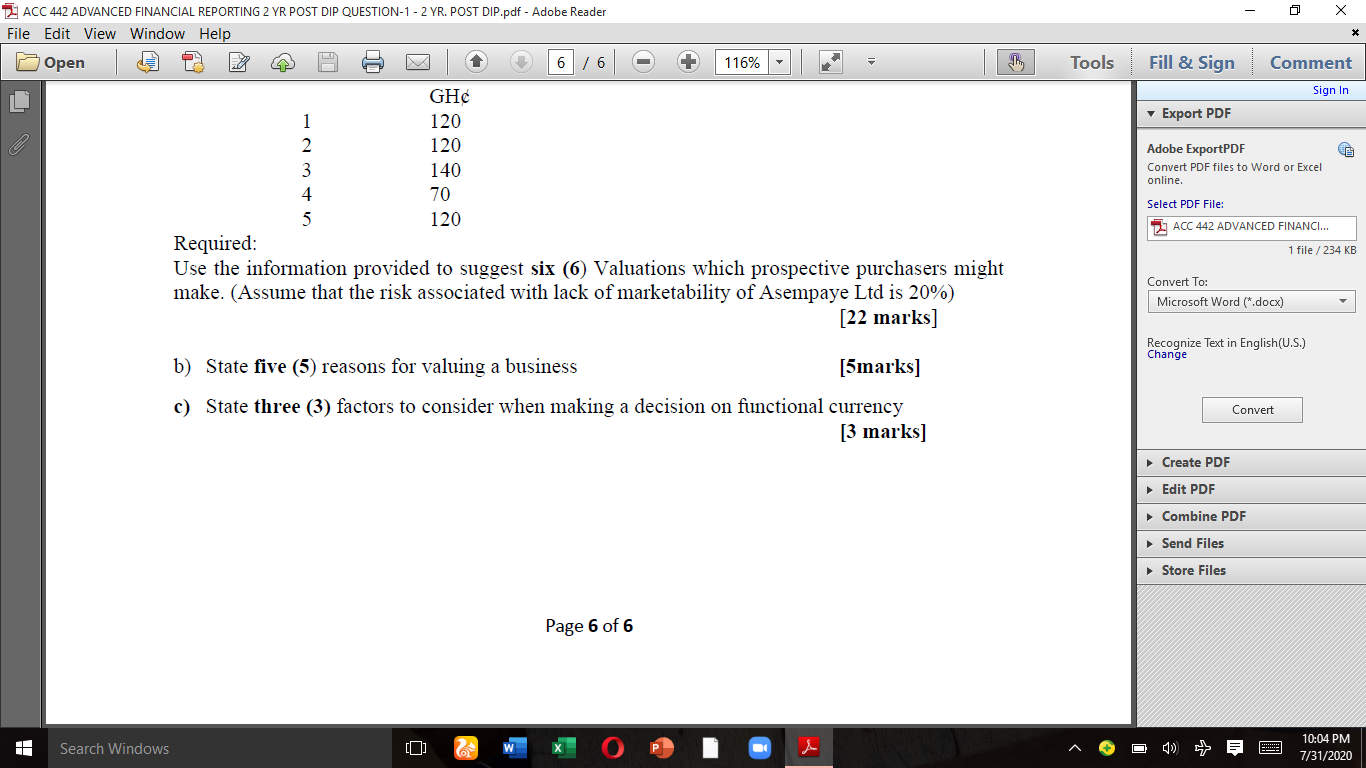

Get step-by-step solutions from verified subject matter experts