Question: z Instructions sept. The Question 100 DO SC . NO 1 2 3 s 4 5 6 7 8 9 0 Q W E R

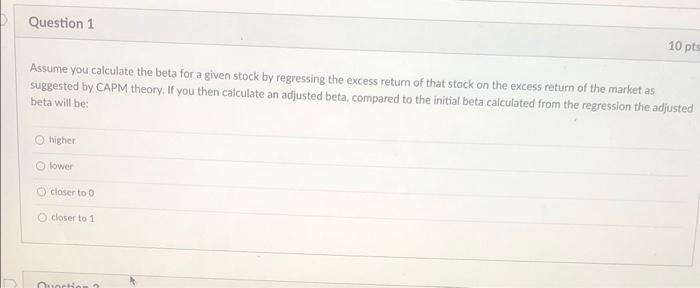

z Instructions sept. The Question 100 DO SC . NO 1 2 3 s 4 5 6 7 8 9 0 Q W E R T Y U 0 A S D F G H K L N N C C V 60 B N N M A * # entro option command COM Question 1 10 pts Assume you calculate the beta for a given stock by regressing the excess return of that stock on the excess return of the market as suggested by CAPM theory. If you then calculate an adjusted beta, compared to the initial beta calculated from the regression the adjusted beta will be: higher lower closer to o closer to 1 unti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts