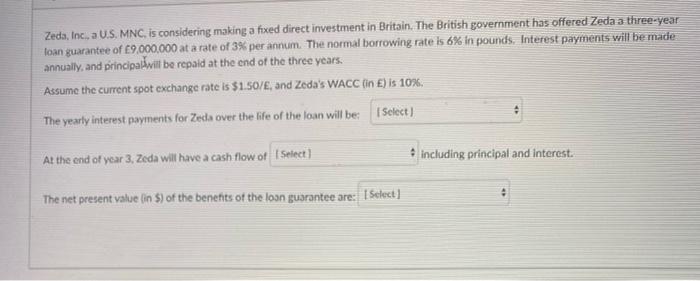

Question: Zeca, Inc., a U.S. MNC is considering making a fixed direct investment in Britain. The British government has offered Zeda a three-year loan guarantee of

Zeca, Inc., a U.S. MNC is considering making a fixed direct investment in Britain. The British government has offered Zeda a three-year loan guarantee of 9,000,000 at a rate of 3% per annum. The normal borrowing rate is 6% in pounds. Interest payments will be made annually, and principavit be repaid at the end of the three years. Assume the current spot exchange rate is $1.50/E, and Zeda's WACC (in E) is 10%. The yearly interest payments for Zeda over the life of the loan will be: Select) At the end of year 3, Zeda will have a cash flow of Select) including principal and interest. The net present value in S) of the benefits of the loan guarantee are: 1 Select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts