Question: Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of $200,000 will produce an initial annual benefit

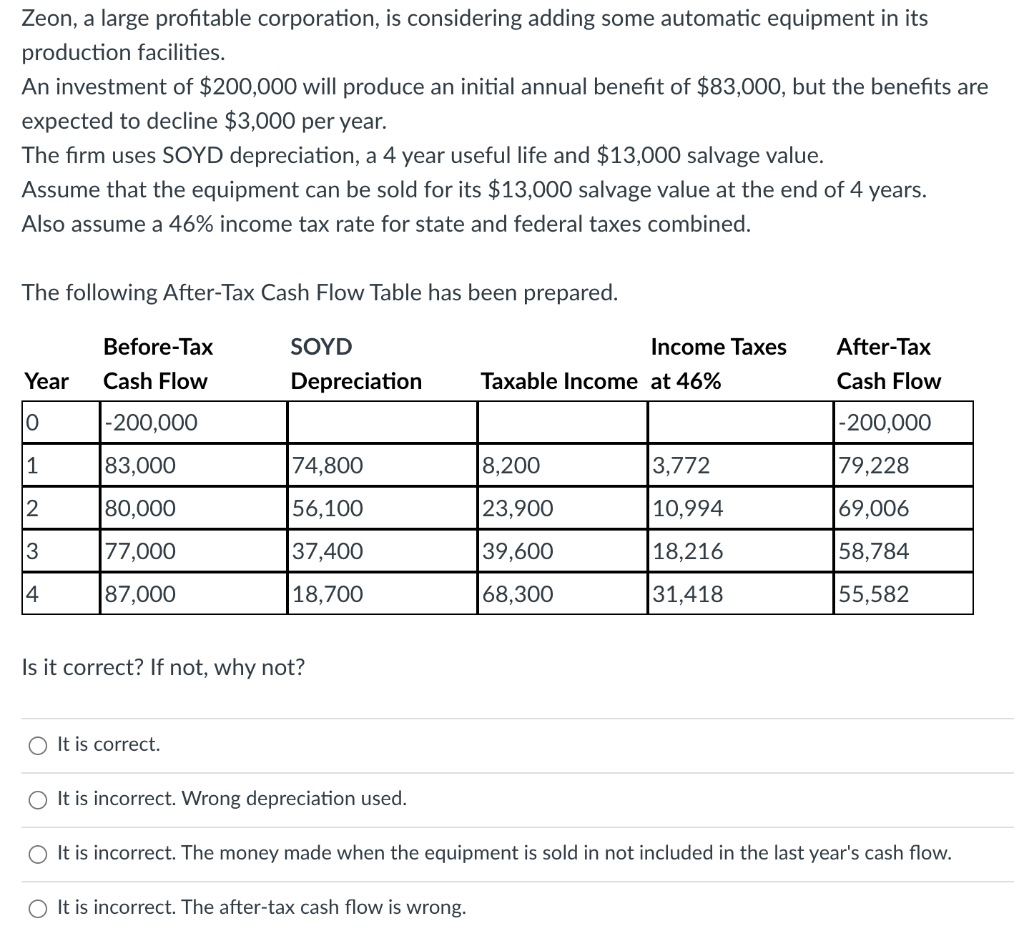

Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of $200,000 will produce an initial annual benefit of $83,000, but the benefits are expected to decline $3,000 per year. The firm uses SOYD depreciation, a 4 year useful life and $13,000 salvage value. Assume that the equipment can be sold for its $13,000 salvage value at the end of 4 years. Also assume a 46% income tax rate for state and federal taxes combined. The following After-Tax Cash Flow Table has been prepared.

| Year | Before-Tax Cash Flow | SOYD Depreciation | Taxable Income | Income Taxes at 46% | After-Tax Cash Flow |

| 0 | -200,000 |

|

|

| -200,000 |

| 1 | 83,000 | 74,800 | 8,200 | 3,772 | 79,228 |

| 2 | 80,000 | 56,100 | 23,900 | 10,994 | 69,006 |

| 3 | 77,000 | 37,400 | 39,600 | 18,216 | 58,784 |

| 4 | 87,000 | 18,700 | 68,300 | 31,418 | 55,582 |

Is it correct? If not, why not?

Group of answer choices

It is correct.

It is incorrect. Wrong depreciation used.

It is incorrect. The money made when the equipment is sold in not included in the last year's cash flow.

It is incorrect. The after-tax cash flow is wrong.

Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of $200,000 will produce an initial annual benefit of $83,000, but the benefits are expected to decline $3,000 per year. The firm uses SOYD depreciation, a 4 year useful life and $13,000 salvage value. Assume that the equipment can be sold for its $13,000 salvage value at the end of 4 years. Also assume a 46% income tax rate for state and federal taxes combined. The following After-Tax Cash Flow Table has been prepared. SOYD Before-Tax Cash Flow Income Taxes Taxable income at 46% After-Tax Cash Flow Year Depreciation 0 - 200,000 -200,000 1 83,000 74,800 8,200 3,772 79,228 2 80,000 56,100 23,900 10,994 69,006 3 77,000 37,400 39,600 18,216 58,784 4 87,000 18,700 68,300 31,418 55,582 Is it correct? If not, why not? O It is correct. It is incorrect. Wrong depreciation used. O It is incorrect. The money made when the equipment is sold in not included in the last year's cash flow. O It is incorrect. The after-tax cash flow is wrong. Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of $200,000 will produce an initial annual benefit of $83,000, but the benefits are expected to decline $3,000 per year. The firm uses SOYD depreciation, a 4 year useful life and $13,000 salvage value. Assume that the equipment can be sold for its $13,000 salvage value at the end of 4 years. Also assume a 46% income tax rate for state and federal taxes combined. The following After-Tax Cash Flow Table has been prepared. SOYD Before-Tax Cash Flow Income Taxes Taxable income at 46% After-Tax Cash Flow Year Depreciation 0 - 200,000 -200,000 1 83,000 74,800 8,200 3,772 79,228 2 80,000 56,100 23,900 10,994 69,006 3 77,000 37,400 39,600 18,216 58,784 4 87,000 18,700 68,300 31,418 55,582 Is it correct? If not, why not? O It is correct. It is incorrect. Wrong depreciation used. O It is incorrect. The money made when the equipment is sold in not included in the last year's cash flow. O It is incorrect. The after-tax cash flow is wrong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts