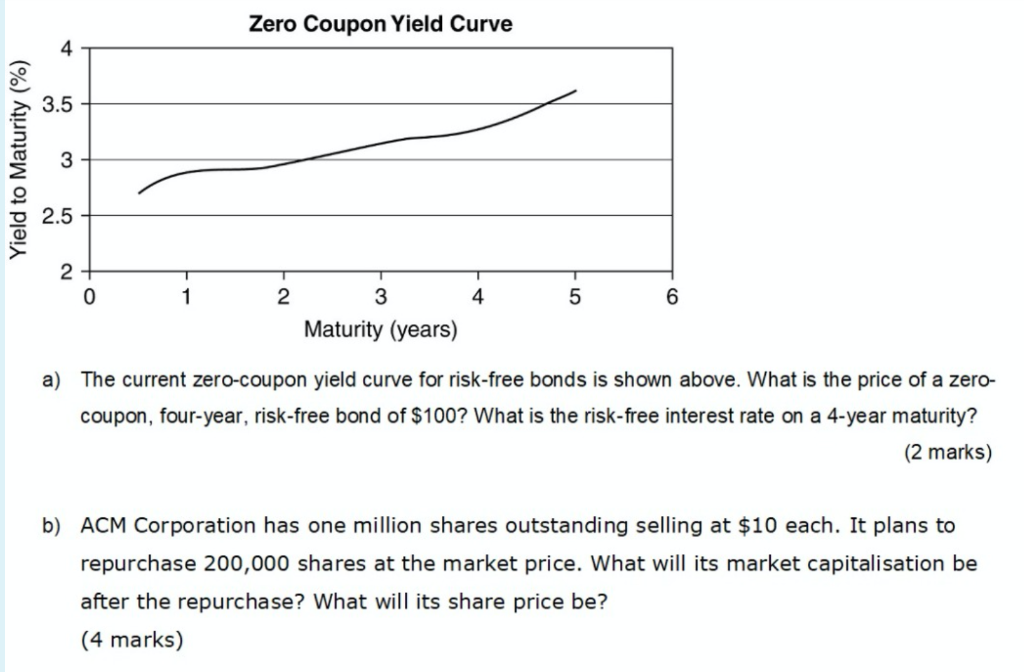

Question: Zero Coupon Yield Curve 3.5 Yield to Maturity (%) 3 2.5 2 0 1 2 4 5 6 3 Maturity (years) a) The current zero-coupon

Zero Coupon Yield Curve 3.5 Yield to Maturity (%) 3 2.5 2 0 1 2 4 5 6 3 Maturity (years) a) The current zero-coupon yield curve for risk-free bonds is shown above. What is the price of a zero- coupon, four-year, risk-free bond of $100? What is the risk-free interest rate on a 4-year maturity? (2 marks) b) ACM Corporation has one million shares outstanding selling at $10 each. It plans to repurchase 200,000 shares at the market price. What will its market capitalisation be after the repurchase? What will its share price be? (4 marks) c) Alish can save $5000 per year. If interest rates are 12%, how long will it take her savings to grow to $60,000?. (4 marks) d) Lim Ltd just paid a dividend of $1 per share. The company's dividend is expected to grow by 20% in the first year and 15% in the second year. From Year 3 onwards, the dividend is expected to grow at a constant rate of 5% forever. The required rate of return is 12%. What is the current price of the company share? (4 marks) Zero Coupon Yield Curve 3.5 Yield to Maturity (%) 3 2.5 2 0 1 2 4 5 6 3 Maturity (years) a) The current zero-coupon yield curve for risk-free bonds is shown above. What is the price of a zero- coupon, four-year, risk-free bond of $100? What is the risk-free interest rate on a 4-year maturity? (2 marks) b) ACM Corporation has one million shares outstanding selling at $10 each. It plans to repurchase 200,000 shares at the market price. What will its market capitalisation be after the repurchase? What will its share price be? (4 marks) c) Alish can save $5000 per year. If interest rates are 12%, how long will it take her savings to grow to $60,000?. (4 marks) d) Lim Ltd just paid a dividend of $1 per share. The company's dividend is expected to grow by 20% in the first year and 15% in the second year. From Year 3 onwards, the dividend is expected to grow at a constant rate of 5% forever. The required rate of return is 12%. What is the current price of the company share? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts