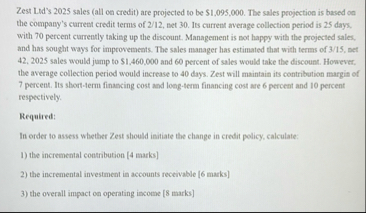

Question: Zest Ldd ' s 2 0 2 5 sales ( all on credit ) are projected to be $ 1 , 0 9 5 ,

Zest Ldds sales all on credit are projected to be $ Tbe sales projection is based on the company's cument credit terms of net Its current mvernge collection period is days. with percent currently taking up the discount. Management is not happy with the projected sales, and has sought ways for improvements. The sales manager has estimated that with terms of net sales would jump to $ and percent of sales would take the discount. However, the average collection period would increase to days. Zest will maintain its contribution margin of percent. Its sbortterm finascing cost and longterm financing cost are percent and percent respectively.

Required:

In order to assess whether Zest should initiate the change in credit policy, calculate:

the incremental contribution marks

the incremental investment in accounts receivable marks

the overall impact on operating income marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock