Question: Zeta Corporation reports the following results for Year 1 and Year 2 Click the icon to view the results for Year 1 and Year 2.)

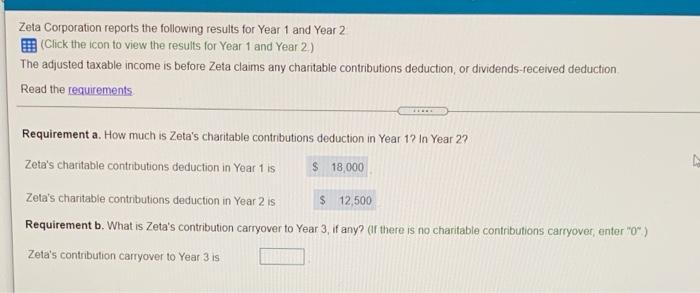

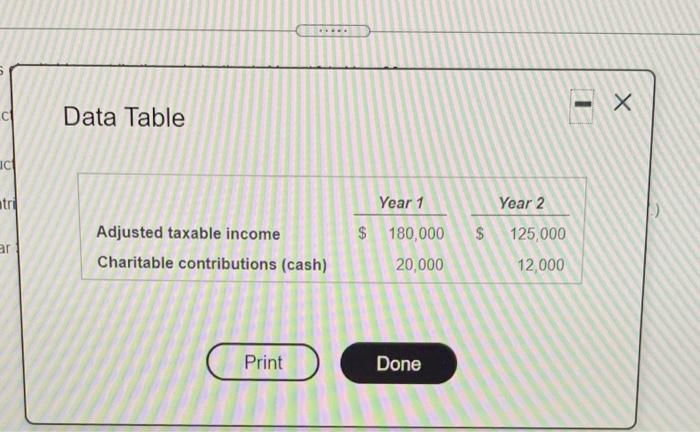

Zeta Corporation reports the following results for Year 1 and Year 2 Click the icon to view the results for Year 1 and Year 2.) The adjusted taxable income is before Zeta claims any charitable contributions deduction, or dividends-received deduction Read the requirements Requirement a. How much is Zeta's charitable contributions deduction in Year 12 In Year 2? Zeta's charitable contributions deduction in Year 1 is $ 18,000 Zeta's charitable contributions deduction in Year 2 is $ 12,500 Requirement b. What is Zeta's contribution carryover to Year 3, if any? (if there is no charitable contributions carryover, "0") Zeta's contribution carryover to Year 3 is - X Data Table ac tri Year 1 Year 2 $ 125,000 ar Adjusted taxable income Charitable contributions (cash) $ 180,000 20,000 12,000 Print Done Requirements a. How much is Zeta's charitable contributions deduction in Year 1? In Year 2? b. What is Zeta's contribution carryover to Year 3, if any? Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts