Question: zimboozy - inclass Q Search Sheet Home Insert Page Layout Formulas DataReview View Conditional Formatting Format as Tablev Arial Paste B IU Number in Cell

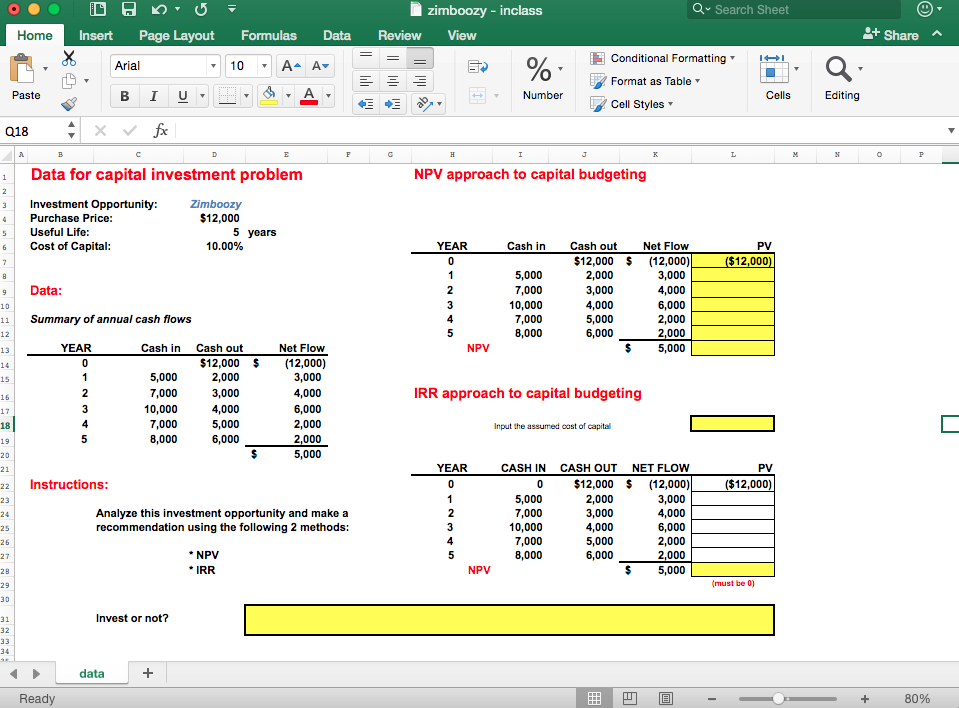

zimboozy - inclass Q Search Sheet Home Insert Page Layout Formulas DataReview View Conditional Formatting Format as Tablev Arial Paste B IU Number in Cell Styles 018X Data for capital investment problem NPV approach to capital budgeting 3 Investment Opportunity: 4 Purchase Price: 5 Useful Life: 6 Cost of Capital: Zimboozy $12,000 5 years 10.00% YEAR Cash in Cash out Net Flow PV $12,000 (12,000) ($12,000) 5,000 7,000 10,000 7,000 8,000 2,000 9 Data 4,000 5,000 6,000 4,000 6,000 2,000 2,000 11 Summary of annual cash flows YEAR Cash in Cash out Net Flow $12,000 (12,000) 4,000 NPV 5,000 7,000 10,000 7,000 8,000 2,000 3,000 4,000 5,000 6,000 IRR approach to capital budgeting 6,000 18 Input the assumed cost of capital 2,000 5,000 YEAR CASH IN CASH OUT NET FLOW 0 $12,000 (12,000) PV 22 Instructions: ($12,000) 5,000 7,000 10,000 7,000 8,000 2,000 3,000 4,000 6,000 2,000 2,000 $5,000 Analyze this investment opportunity and make a recommendation using the following 2 methods: 4,000 5,000 6,000 NPV IRR NPV must be 0) Invest or not? 32 data Ready 80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts