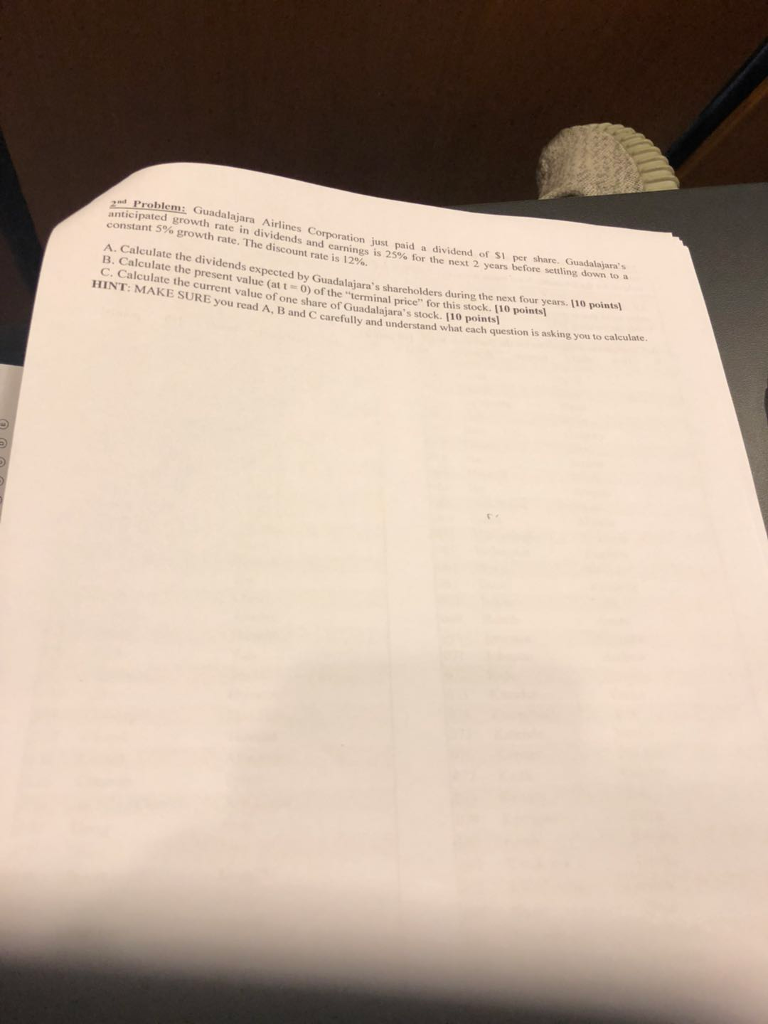

Question: znd Problemi constant e anticipated growth rate in dividends and constant 5% growth rate. The discount rate is 12%. A. Calculate the dividends Guadalajara's B.

znd Problemi constant e anticipated growth rate in dividends and constant 5% growth rate. The discount rate is 12%. A. Calculate the dividends Guadalajara's B. Calculate the C. Calculate the c just paid a dividend of SI per share. Guadalajara's earnings is 25% for the next 2 years before settling down to a expected by Guadalajara's shareholders during the next four years. (10 points late the current valut-) of the "terminal price" for this stock. (10 points rrnt value of one share of Guadalajara's stock. 10 pointsl ou read A, B and C carefully and understand what each question is asking you to calculaie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts