Question: Zoom Inc is thinking about inesting money into a 7 -year project that would greathy enhance its video and scund quality, it expects $130,000 in

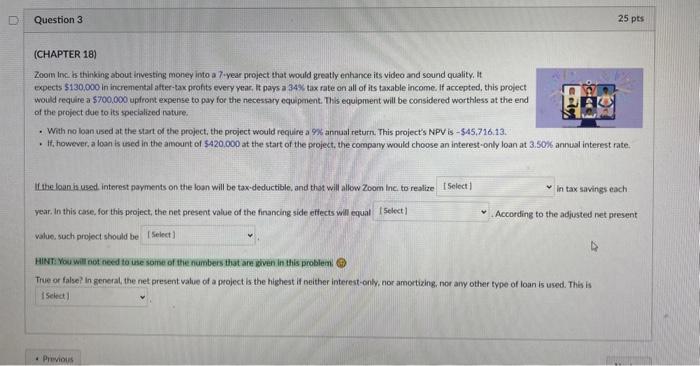

Zoom Inc is thinking about inesting money into a 7 -year project that would greathy enhance its video and scund quality, it expects $130,000 in incremental atter-tax profits every year, It pays a 34% tax rate cn all of its taxable income. If accepted, this project would require a $700,000 epfront expense to pay for the necessary equipment. This equipment will be considered worthless at the end of the project due to its speclalized nature. - With no loan used at the start of the project, the project would require a 90 annual return. This project's NPV is - 545,716,13. - It, however, a loan is uned in the amount of 5420,000 at the start of the project, the company would choose an interest-only loan at 3.5006 annual interest rate. If the loan is used. interest payments on the loan will be tax-deductible, and thot will allow Zoom lnc. to realize in tax savingench Year, In this case, for this project, the net present value of the financing side efiects will equal According to the adjusted ret present value, such project should be HINT: You will net nexd to use soime of the numbers that are ioven in this problem True or false? in general, the net present value of a project is the highest if neither interest-only, nor amortizing, nor any other type of loan is used. This is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts