A fund has an initial investment of $100 million from investors. The investors will receive an 8

Question:

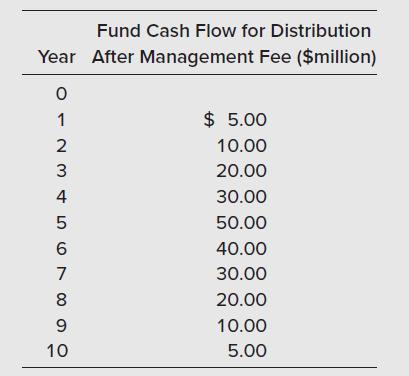

A fund has an initial investment of $100 million from investors. The investors will receive an 8 percent preferred return. After the preferred return is met, remaining distributions will be split 80 percent to the investors and 20 percent to the fund manager. Funds available for distribution after the regular fund management fee are as follows:

a. How many years will it take until the investor gets the 8 percent preferred return?

b. What will be the split in distributions to the investor and the manager for the year found in part a?

c. What will the investor’s IRR be over the entire 10 years?

d. What will the total promote earned by the fund manager be for the 10 years?

Step by Step Answer:

Real Estate Finance And Investments

ISBN: 9781264072941

17th Edition

Authors: William Brueggeman, Jeffrey Fisher