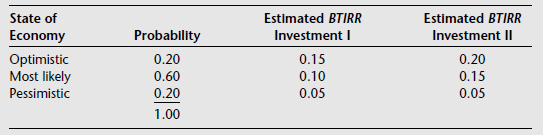

Question: Mike Riskless is considering two projects. He has estimated the IRR for each under three possible scenarios and assigned probabilities of occurrence to each scenario.

Mike Riskless is considering two projects. He has estimated the IRR for each under three possible scenarios and assigned probabilities of occurrence to each scenario.

Riskless is aware that the pattern of returns for Investment II looks very attractive relative to Investment I; however, he believes that Investment II could be more risky than Investment I. He would like to know how he can compare the two investments considering both the risk and return on each. What do you suggest?

State of Economy Optimistic Most likely Pessimistic Estimated BTIRR Investment II Estimated BTIRR Investment I Probability 0.20 0.15 0.20 0.60 0.20 0.15 0.05 0.05 1.00

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

INVESTMENT I 1 2 3 4 5 6 Estimated Expected Deviation Squared Product BTIRR Return 1 2 Deviation Pro... View full answer

Get step-by-step solutions from verified subject matter experts