On March 31, 2019, Big Boats Company entered into a contract with Vacations Unlimited to produce a

Question:

On March 31, 2019, Big Boats Company entered into a contract with Vacations Unlimited to produce a state-of-the-art cruise ship to be completed within three years. Big Boats estimated the total cost of building the ship at $300,000,000. The contract price was $400,000,000. The ship was completed on February 15, 2022.

a. What tax accounting method must Big Boats use for the contract? Why?

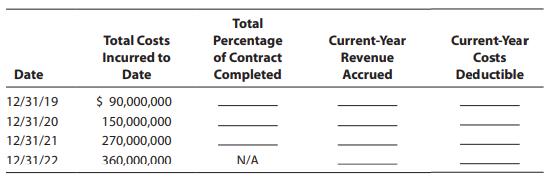

b. Using the financial data provided relating to the contract’s performance, complete the following schedule.

c. What are the consequences of the total cost of $360,000,000 exceeding the estimated total cost of $300,000,000?

Step by Step Answer:

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman