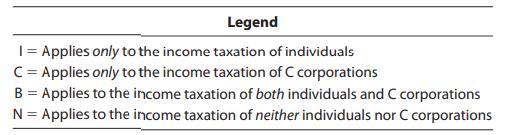

Using the legend provided below, classify each statement under 2021 tax law. a. A child care credit

Question:

Using the legend provided below, classify each statement under 2021 tax law.

a. A child care credit is available.

b. The deduction of charitable contributions is subject to percentage limitation(s).

c. Excess charitable contributions can be carried forward for five years.

d. On the contribution of inventory to charity, the full amount of any appreciation can be claimed as a deduction.

e. Excess capital losses can be carried forward indefinitely.

f. Excess capital losses cannot be carried back.

g. A net short-term capital gain is subject to the same tax rate as ordinary income.

h. The deduction for qualified business income may be available.

i. A dividends received deduction is available.

j. The like-kind exchange provisions of § 1031 are available.

k. A taxpayer with a fiscal year of May 1–April 30 has a due date for filing a Federal income tax return of July 15.

l. Estimated Federal income tax payments may be required.

Step by Step Answer:

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman