Assume the same facts as in Problem 43, with the following exceptions: Reece purchased the land

Question:

Assume the same facts as in Problem 43, with the following exceptions:

• Reece purchased the land five years ago for $120,000. Its fair market value was $90,000 when it was contributed to the LLC.

• Phoenix sold the land contributed by Reece for $84,000.

a. How much is the recognized gain or loss? How is it allocated among the LLC members?

b. Prepare a balance sheet reflecting basis and fair market value for the LLC immediately after the land sale. Also prepare schedules that support the basis and fair market value of each LLC member’s capital account.

Data From Problem 43:

Phoebe and Parker are equal members in Phoenix Investors, LLC. They are real estate investors who formed the LLC several years ago with equal cash contributions.Phoenix then purchased a parcel of land.

On January 1 of the current year, to acquire a one-third interest in the entity, Reece contributed to the LLC some land she had held for investment. Reece purchased the land five years ago for $75,000; its fair market value at the contribution date was $90,000. No special allocation agreements were in effect before or after Reece was admitted to the LLC. Phoenix holds all land for investment.

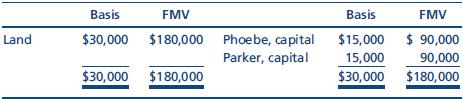

Immediately before Reece’s property contribution, the balance sheet of Phoenix Investors, LLC, was as follows:

Step by Step Answer:

South Western Federal Taxation 2015

ISBN: 9781305310810

38th Edition

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young