Brooke, Baker, and Bulstrode own 25%, 25%, and 50% interests, respectively, in the B&B Partnership. B&B is

Question:

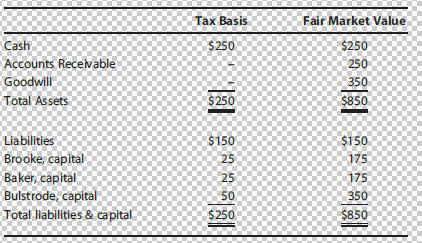

Brooke, Baker, and Bulstrode own 25%, 25%, and 50% interests, respectively, in the B&B Partnership. B&B is a cash basis tax entity with the following balance sheet:

Assume that liabilities are shared proportionately by the partners and that each partner’s capital account equals the partner’s basis before considering liabilities. On the balance sheet date, Brooke purchases Baker’s 25% interest in the partnership, paying Baker $175 cash and assuming Baker’s share of the partnership liabilities. As a result of this buyout of her partnership interest, what is the total gain on sale that Baker should report on her individual tax return?

a. $112.50

b. No gain or loss will be reported

c. $187.50

d. $150

Step by Step Answer:

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young