Build an Excel spreadsheet that calculates annual cost recovery and end-ofyear adjusted basis for MACRS 3-, 5-,

Question:

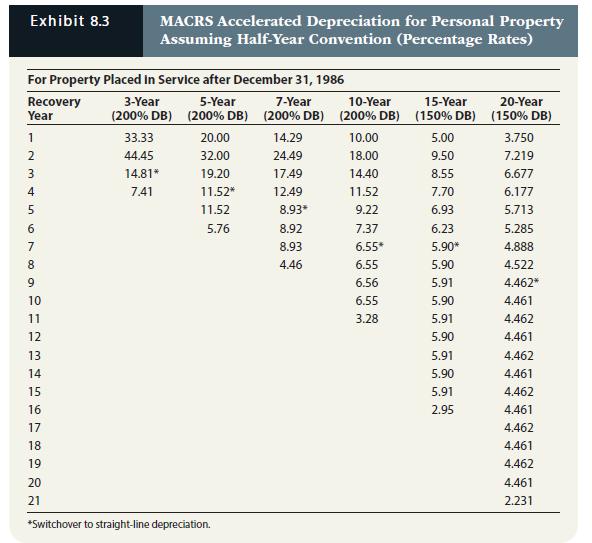

Build an Excel spreadsheet that calculates annual cost recovery and end-ofyear adjusted basis for MACRS 3-, 5-, and 7-year assets. Begin by constructing a table that incorporates the relevant MACRS cost recovery percentages from Exhibit 8.3. Then build a table that links to the MACRS cost recovery table, allowing a user to input three data points:

(1) Asset cost,

(2) Year of acquisition, and

(3) MACRS life.

Based on these inputs, your spreadsheet should create a schedule that provides annual MACRS cost recovery and end-of-year adjusted basis for that asset. Once completed, e-mail the spreadsheet to your instructor. Your spreadsheet needs to use “IF” functions to create the MACRS cost recovery/adjusted basis schedule.

Step by Step Answer:

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young