Clark and Hunt organized Jet Corp, with authorized voting common stock of $400,000. Clark contributed $60,000 cash.

Question:

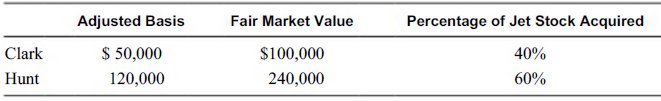

Clark and Hunt organized Jet Corp, with authorized voting common stock of $400,000. Clark contributed $60,000 cash. Both Clark and Hunt transferred other property in exchange for Jet stock as follows:

What was Clark's basis in Jet stock?

a. $0

b. $100,000

c. $110,000

d. $160,000

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted: