During 2022, Inez (a single taxpayer) had the following transactions involving capital assets: How much income tax

Question:

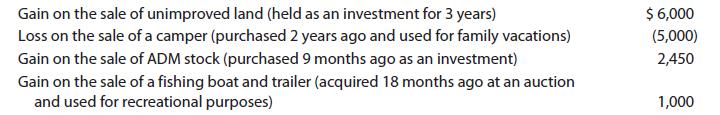

During 2022, Inez (a single taxpayer) had the following transactions involving capital assets:

How much income tax results from these capital asset transactions if:

a. Inez has taxable income of $188,450?

b. Inez has taxable income of $32,250?

Transcribed Image Text:

Gain on the sale of unimproved land (held as an investment for 3 years) Loss on the sale of a camper (purchased 2 years ago and used for family vacations) Gain on the sale of ADM stock (purchased 9 months ago as an investment) Gain on the sale of a fishing boat and trailer (acquired 18 months ago at an auction and used for recreational purposes) $ 6,000 (5,000) 2,450 1,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

a Inez has a net LTCG of 7000 and a net STCG of 2450 Given her taxable income Ine...View the full answer

Answered By

Sarfraz gull

have strong entrepreneurial and analytical skills which ensure quality tutoring and mentoring in your international business and management disciplines. Over last 3 years, I have expertise in the areas of Financial Planning, Business Management, Accounting, Finance, Corporate Finance, International Business, Human Resource Management, Entrepreneurship, Marketing, E-commerce, Social Media Marketing, and Supply Chain Management.

Over the years, I have been working as a business tutor and mentor for more than 3 years. Apart from tutoring online I have rich experience of working in multinational. I have worked on business management to project management.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

During 2021, Inez (a single taxpayer) had the following transactions involving capital assets: Gain on the sale of unimproved land (held as an investment for 3 years) $ 6,000 Loss on the sale of a...

-

During 2021, Chester (a married taxpayer filing a joint return) had the following transactions involving capital assets: Gain on the sale of an arrowhead collection (acquired as an investment at...

-

During 2022, Chester (a married taxpayer filing a joint return) had the following transactions involving capital assets: How much income tax results from these capital asset transactions if: a....

-

An opera glass has an objective lens of focal length +3.60 cm and a negative eyepiece of focal length -1.20 cm. How far apart must the two lenses be for the viewer to see a distant object at 25.0 cm...

-

Key figures for the recent two years of Research In Motion and Apple follow. Required 1. Compute the current ratio for both years for both companies. 2. Which company has the better ability to pay...

-

The personnel director of Hatch Financial. which recently absorbed another firm, is now downsizing and must relocate five information systems analysts from recently closed locations. Unfortunately,...

-

The Durbin-Watson statistic is designed to detect autocorrelation and is defined by \[D W=\frac{\sum_{t=2}^{T}\left(y_{t}-y_{t-1} ight)^{2}}{\sum_{t=1}^{T}\left(y_{t}-\bar{y} ight)^{2}} .\] a. Derive...

-

Mason Olson is chairman of the board of Healthy Fast Foods, Inc. Suppose Olson has just founded Healthy Fast Foods, and assume that he treats his home and other personal assets as part of Healthy...

-

Popular furniture company, IKEA, has purchased forests in Romania as well as land in Alabama to assist with keeping up with the wood demand necessary to complete customer orders. This was one way...

-

Terri, age 16, is a dependent of her parents. During 2022, Terri earned $5,000 in interest income and $3,000 from part-time jobs. a. What is Terris taxable income? b. How much of Terris income is...

-

Nadia died in 2021 and is survived by her husband, Jerold (age 44); her married son, Travis (age 22); and her daughter-in-law, Macy (age 18). Jerold is the executor of his wifes estate. He maintains...

-

For each situation given, calculate cost of goods sold and identify if the information provided reflects a perpetual or periodic inventory system. a. b. A physical inventory count at year-end showed...

-

The CFO of Amazon.com Inc. is thinking of borrowing Japanese yen because of its low interest rate, currently at 1%. The current interest rate on U.S. dollars is 3%. What is your advice to the CFO?

-

Suppose Lufthansa buys $400 million worth of Boeing jets in 2018 and is financed by the U.S. Eximbank with a five-year loan that has no principal or interest payments due until 2019. What is the net...

-

Carrier Air Conditioner, a division of United Technologies, is thinking of shifting virtually all the labor-intensive portion of its production from Indiana to Mexico. What risks is Carrier likely to...

-

In early 2018, the short-term interest rate in the Japan was 0.1%, and forecast Japanese inflation was 1.2%. At the same time, the short-term South Korean interest rate was 1.68% and forecast South...

-

Lothar Drake wishes to estimate the value of an asset expected to provide cash inflows of $4,000 at the end of years 1 and 2, $5,000 at the end of years 3 and 4, and $4,500 at the end of year 5. His...

-

Summarize the factors that can lead to a change in bank reserves.

-

TRUE OR FALSE: 1. Banks with a significantly large share of fixed-interest rate home loans are less exposed to interest rate risks. 2. Although Australian banks are pretty big, they are not...

-

Faye, Gary, and Heidi each have a one-third interest in the capital and profits of the FGH Partnership. Each partner had a capital account of $50,000 at the beginning of the tax year. The partnership...

-

Liz and Doug were divorced on December 31 of the current year after 10 years of marriage. Their current year's income received before the divorce was as follows: Doug's salary...

-

Liz and Doug were divorced on December 31 of the current year after 10 years of marriage. Their current year's income received before the divorce was as follows: Doug's salary...

-

the following questions: Consider the following snippet of MIPS code and answer SW r16, 12(r6) lw r16, 8(r6) add r5,r1,r16 slt r3,r5,r4 Consider the MIPS pipeline architecture we have been discussing...

-

Give the type and value of each of the following Java expressions. If it leads to a compile-time or runtime-error, specify that for the type (and leave the value column blank). Java Expression Type...

-

Consider the following C code, which adds d to first 100 elements of array B and stores the result in array A. Both A and B are arrays of 64-bit integers, and d is a 64-bit integer. Assume A, B, and...

Study smarter with the SolutionInn App