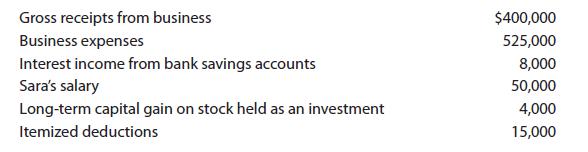

During 2022, Rick and his wife, Sara, had the following items of income and expense to report:

Question:

During 2022, Rick and his wife, Sara, had the following items of income and expense to report:

a. Assuming that Rick and Sara file a joint return, what is their taxable income for 2022?

b. What is the amount of Rick and Sara’s NOL for 2022?

c. To what years can Rick and Sara’s NOL be carried?

d. Based on your computations, identify the components of their NOL. What is the rationale for excluding the items that do not affect the NOL computation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted: