Gus, who is married and files a joint return, owns a grocery store. In 2017, his gross

Question:

Nonbusiness capital gains (short term) ................................. $20,000

Nonbusiness capital losses (long term) .................................. 9,000

Itemized deductions (no casualty or theft) ............................ 18,000

Ordinary nonbusiness income ................................................ 8,000

Salary from part-time job ......................................................... 10,000

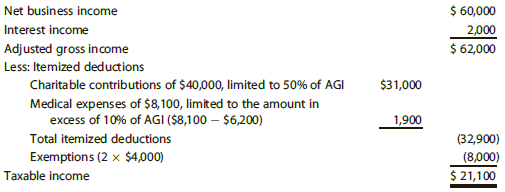

In 2015, Gus had taxable income of $21,100 computed as follows:

a. What is Gus€™s 2017 NOL?

b. Determine Gus€™s recomputed taxable income for 2015.

c. Determine the amount of Gus€™s 2017 NOL to be carried forward from 2015 to 2016.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation Individual Income Taxes 2018

ISBN: 9781337385893

41st Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young, Nellen

Question Posted: