In 2017, Gail changed from the lower of cost or market FIFO method to the LIFO inventory

Question:

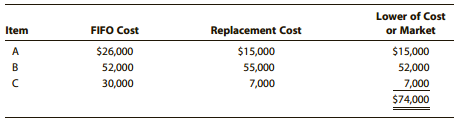

Item C was damaged goods, and the replacement cost used was actually the esti-mated selling price of the goods. The actual cost to replace item C was $32,000.

a. What is the correct beginning inventory for 2017 under the LIFO method?

b. What immediate tax consequences (if any) will result from the switch to LIFO?

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation Individual Income Taxes 2018

ISBN: 9781337385893

41st Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young, Nellen

Question Posted: