In 2022, Ava, an employee, has AGI of $58,000 and the following itemized deductions: What is Avas

Question:

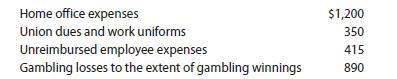

In 2022, Ava, an employee, has AGI of $58,000 and the following itemized deductions:

What is Ava’s total itemized deduction related to these items?

Transcribed Image Text:

Home office expenses Union dues and work uniforms Unreimbursed employee expenses Gambling losses to the extent of gambling winnings $1,200 350 415 890

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

890 all of the expenses other than the g...View the full answer

Answered By

Chandra Kumari

I completed my masters degree in Biochemistry. Worked as HOD of biochemistry department in a reputed hospital. Present am working as online tutor for needful for the past 6years. I can help you to the extent you want in the subject matter. In my leisure time I used to educate children at nearby orphanage about selfcare n cleanliness (girl children).

At present I am working as a professor in Biochemistry at Andhra Loyola degree college..

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Multiple choice questions: 1. Samuel is a CPA and earns $150,000 from his practice in the current year. He also has an ownership interest in three passive activities. Assume he is sufficiently at...

-

Multiple Choice Questions 1. Which expense, incurred and paid in 2014, can be claimed as a miscellaneous itemized deduction subject to the 2% of AGI floor? a. Self-employed health insurance. b....

-

In Exercises 2324, find the standard form of the equation of each hyperbola satisfying the given conditions. Foci: (0, -4), (0, 4); Vertices: (0, -2), (0, 2)

-

Explain how a user goal can be used as a technique to identify use cases.

-

Much has been written about leveraged buyouts (LBOs). Are they a good thing?

-

Should medical advice be dispensed on the telephone? Explain your opinion.

-

Five months before the new 2002 Lexus ES hit showroom floors, the company's U.S. engineers sent a test report to Toyota City in Japan: The luxury sedan shifted gears so roughly that it was "not...

-

A U.S. consumer observes that a golf club costs $300. Currently in the spot market, 1 euro can be exhanged for $1.3602. If purchasing power parity (PPP) holds, how many euros should you expect to pay...

-

In 2022, the CEO of Crimson, Inc., entertains seven clients at a skybox in Memorial Stadium for a single athletic event during the year. Substantive business discussions occurred at various times...

-

In 2022, Robert takes four key clients and their spouses out to dinner at a local restaurant. Business discussions occurred over dinner. Expenses were $700 (drinks and dinner) and $140 (tips to...

-

Consider the series queue with blocking we discussed in class (simple sequential two-station, single-server-at-each-station model, where no queue is allowed to form at either station.) Using...

-

Frederick Confectioner does business in multiple states, including one state that uses the UDITPA formula to apportion income. If the companys taxable income is $3,500,000, its property factor in the...

-

Elbert Manufacturing, Inc. does business in two states. Each state uses the single- factor sales formula to apportion income. State 1 imposes a 5% tax on income, and State 2 imposes an 8% tax on...

-

Welch Manufacturing has $5,000,000 of taxable income. One of the states in which it does business is Kentucky, which uses the three-factor formula with a double-weighted sales factor to apportion...

-

In the current year, a beneficiary receives a distribution from a 529 Savings Plan in the amount of $50,000. $12,000 of the $50,000 represents distributed earnings. If the beneficiary's qualified...

-

Viva Yeboahs 401(k) plan provides a supplemental Roth 401(k) arrangement. If Vivas compensation is $500,000, will she be eligible to contribute to a Roth 401 (k) account? Explain why or why not.

-

You are planning to invest $2,500 today for three years at a nominal interest rate of 9 percent with annual compounding. a. What would be the future value (FV) of your investment? b. Now assume that...

-

d) For die casting processes: 1. What are the most common metals processed using die casting and discuss why other metals are not commonly die casted? 2. Which die casting machines usually have a...

-

Distinguish between taxes that are proportional and those that are progressive.

-

Distinguish between taxes that are proportional and those that are progressive.

-

Distinguish between taxes that are proportional and those that are progressive.

-

.What is meant by the concept of shared and non-shared environmental experiences ?

-

8. (4) The 1-year interest rate on Swiss francs, is, is 5 percent and the dollar interest rate, is, is 8 percent. Use the uncovered interest parity relationship 1+i = (1+i) Ee E where i = domestic...

-

Describe the key roles of Financial Analysis as it relates to evaluating projects and equipment purchases.

Study smarter with the SolutionInn App