In 20X12 Randall suffered bodily injury while at work. On his 20X12 tax return Randall deducted related

Question:

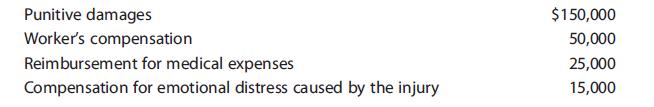

In 20X12 Randall suffered bodily injury while at work. On his 20X12 tax return Randall deducted related medical expenses of $10,000; and $5,000 in 20X13. In 20X14 Randall won a worker’s compensation claim and prevailed in an injury lawsuit, both in connection with the 20X12 injury. Randall received the following in 20X14 as settlement:

What amount of the settlement should be excluded from Randall’s 20X14 gross income?

a. $ 75,000

b. $ 60,000

c. $ 90,000

d. $165,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted: