In December of each year, Eleanor Young contributes 10% of her gross income to the United Way

Question:

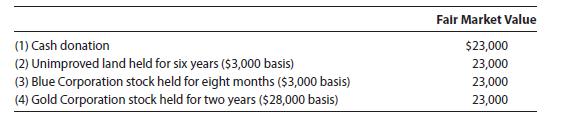

In December of each year, Eleanor Young contributes 10% of her gross income to the United Way (a 50% organization). Eleanor, who is in the 24% marginal tax bracket, is considering the following alternatives for satisfying the contribution.

Eleanor has asked you to help her decide which of the potential contributions listed above will be most advantageous taxwise. Evaluate the four alternatives, and write a letter to Eleanor to communicate your advice to her. Her address is 2622 Bayshore Drive, Berkeley, CA 94709.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted: