Karen Samuels (Social Security number 123-45-6789) makes the following purchases and sales of stock: Assuming that Karen

Question:

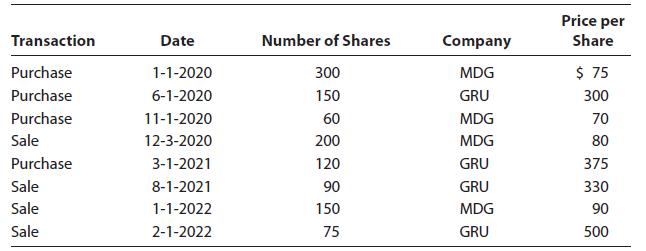

Karen Samuels (Social Security number 123-45-6789) makes the following purchases and sales of stock:

Assuming that Karen is unable to identify the specific lots that are sold with the original purchase, determine the recognized gain or loss on each type of stock.

a. As of July 1, 2020.

b. As of December 31, 2020.

c. As of December 31, 2021.

d. As of July 1, 2022.

e. Form 8949 and Schedule D (Form 1040) are used to report sales of capital assets (which include stock sales). Go to the IRS website, and download the most current Form 8949 and Schedule D (Form 1040). Then complete the forms for part (c) of this problem, assuming that the brokerage firm did not report Karen’s basis to the IRS [complete Schedule D (Form 1040) through line 16].

Step by Step Answer:

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young