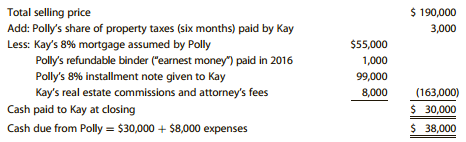

Kay, who is not a dealer, sold an apartment house to Polly during the current year (2017).

Question:

During 2017, Kay collected $9,000 in principal on the installment note and $2,000 of interest. Kay€™s basis in the property was $110,000 [$125,000 - $15,000 (depreciation)].

The Federal rate is 6%.

a. Compute the following:

1. Total gain.

2. Contract price.

3. Payments received in the year of sale.

4. Recognized gain in the year of sale and the character of such gain.

b. Same as parts (a)(2) and (3), except that Kay€™s basis in the property was $35,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted: