Kim Corporation, a calendar year taxpayer, operates manufacturing facilities in States A and B. A summary of

Question:

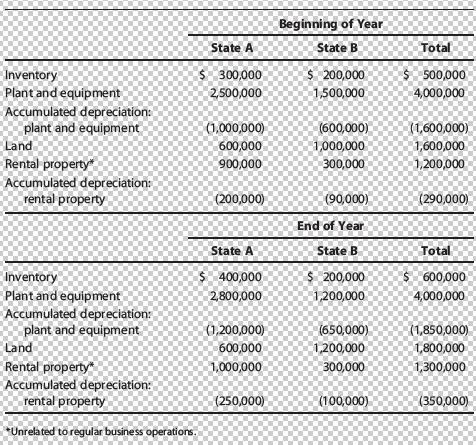

Kim Corporation, a calendar year taxpayer, operates manufacturing facilities in States A and B. A summary of Kim’s property holdings follows.

Determine Kim’s property factors for the two states. The statutes of both A and B provide that average historical cost of business property is to be included in the property factor.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To determine Kim Corporations property factors for States A and B we need to calculate the average historical cost of business property in each state ...View the full answer

Answered By

Rashul Chutani

I have been associated with the area of Computer Science for long. At my university, I have taught students various Computer Science Courses like Data Structures, Algorithms, Theory of Computation, Digital Logic, System Design, and Machine Learning. I also write answers to questions posted by students in the area of and around Computer Science.

I am highly fortunate to receive great feedback on my teaching skills that keeps me motivated. Once a student sent me an email stating that I had explained to him a concept better than his professor did.

I believe in the fact that "Teaching is the best way to learn". I am highly fascinated by the way technology nowadays is solving real-world problems and try to contribute my bit to the same.

Besides tutoring, I am a researcher at the Indian Institute of Technology. My present works are in the area of Text Summarization and Signal and Systems.

Some of my achievements include clearing JEE Advanced with an All India Rank of 306 out of 1.5 million contesting candidates and being the Department Ranker 1 at my University in the Department of Computer Science and Engineering.

I look forward to providing the best Tutoring Experience I can, to the student I teach.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kims property holdings follows. Determine Kims property factors for the two states assuming...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Consider the market for milk. Draw a supply curve and a demand curve (is the demand curve elastic on inelastic). Label the equilibrium price and quantity. Suppose that the production of milk causes...

-

The Robinsons have found the house of their dreams. They have $50,000 to use as a down-payment and they want to borrow $250,000 from the bank. The current mortgage interest rate is 6%. If they make...

-

As the newest member of your company's Budgeting and Forecasting Division, you try to be respectful and helpful to all of your colleagues. When you complimented your supervisor Sarah on her tan, she...

-

What recruiting objectives are being met through the use of online recruitment?

-

Your audit firm has been the auditor of Cowan Industries for a number of years. The company manufactures a wide range of lawn care products and typically sells to major retailers. In recent years,...

-

The following information is available for Baker Industries: Cost of goods manufactured Beginning finished goods inventory Ending finished goods inventory Required: Compute the cost of goods sold....

-

Assume the same facts as in Problem 31, except that both states employ a three-factor formula, under which sales are double-weighted. The property factor in A is computed using historical cost, while...

-

Using the following information from the books and records of Grande Corporation, determine Grandes total sales that are subject to State Cs sales tax. Grande operates a retail general store.

-

The following information is available for Barkley Company at December 31, 2008, regarding its investments. Instructions (a) Prepare the adjusting entry (if any) for 2008, assuming the securities are...

-

can you paraphrase this sentence. Community Hospital has been considering offering a new clinic for hospital employees and their dependents, and I've been chosen by the account manager to assist with...

-

A famous painting was sold in 1946 for $21,230. In 1960 the painting was sold for $31.4 million. What rate of interest compounded continuously did this investment sam As an investment, the painting...

-

A stream of nitrogen is initially at 20 bar and 400 K, and at a velocity 10 m/s. Determine the final velocity and temperature of the stream if its pressure is reduced to 5 bar by passing through: a)...

-

Earnhardt Driving School's 2018 balance sheet showed net fixed assets of $5.4 million, and the 2019 balance sheet showed net fixed assets of $6 million. The company's 2019 income statement showed a...

-

A two reactor system is comprised of a CSTR and a PFR in series. The PFR is twice the volume of the CSTR. Sketch the effluent concentration from the two reactor system (i.e., effluent from the second...

-

What are the different categories of hedge funds?

-

What is the amount of total interest dollars earned on a $5,000 deposit earning 6% for 20 years?

-

Would you expect to find any wholesalers selling the various types of business products? Are retail stores required (or something like retail stores)?

-

What kinds of business products are the following: ( a ) lubricating oil, ( b ) electric motors, and ( c ) a firm that provides landscaping and grass mowing for an apartment complex? Explain your...

-

How do raw materials differ from other business products? Do the differences have any impact on their marketing mixes? If so, what specifically?

-

Jammer Corporation holds cash of $8,000 and owes $28,000 on accounts payable. Jammer has accounts receivable of $41,000, inventory of $24,000, and land that cost $60,000. How much are Jammer's total...

-

A company reports investing cash flows of - $ 1 , 4 3 0 , financing cash flows of $ 6 4 0 , and a change in total cash of $ 3 5 0 What is the amount of cash flows from operating activities? (...

-

Compare and contrast nonprofit management with for-profit business management. In your view, what are the three most important differences that effective managers should be aware of?

Study smarter with the SolutionInn App