Linda, who files as a single taxpayer, had AGI of $280,000 for 2022. She incurred the following

Question:

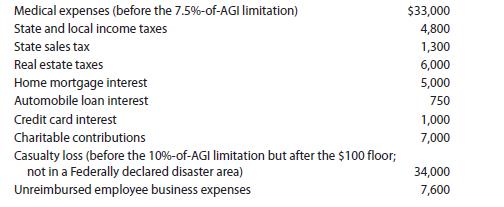

Linda, who files as a single taxpayer, had AGI of $280,000 for 2022. She incurred the following expenses and losses during the year:

Calculate Linda’s allowable itemized deductions for the year.

Transcribed Image Text:

Medical expenses (before the 7.5%-of-AGI limitation) State and local income taxes State sales tax Real estate taxes Home mortgage interest Automobile loan interest Credit card interest Charitable contributions Casualty loss (before the 10%-of-AGI limitation but after the $100 floor; not in a Federally declared disaster area) Unreimbursed employee business expenses $33,000 4,800 1,300 6,000 5,000 750 1,000 7,000 34,000 7,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Lindas itemized deductions are computed as follows The aut...View the full answer

Answered By

Khurram shahzad

I am an experienced tutor and have more than 7 years’ experience in the field of tutoring. My areas of expertise are Technology, statistics tasks I also tutor in Social Sciences, Humanities, Marketing, Project Management, Geology, Earth Sciences, Life Sciences, Computer Sciences, Physics, Psychology, Law Engineering, Media Studies, IR and many others.

I have been writing blogs, Tech news article, and listicles for American and UK based websites.

4.90+

5+ Reviews

17+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Linda, who files as a single taxpayer, had AGI of $280,000 for 2018. She incurred the following expenses and losses during the year: Medical expenses (before the 75%-of-AGI limitation)...

-

Linda, age 37, who files as a single taxpayer, had AGI of $280,000 for 2018. She incurred the following expenses and losses during the year: Medical expenses (before the 7.5%-of-AGI limitation) ...

-

Linda, who files as a single taxpayer, had AGI of $280,000 for 2017. She incurred the following expenses and losses during the year: Medical expenses (before the 10%-of-AGI limitation)...

-

Factor completely. p(p + 2) + p(p + 2) - 6(p + 2)

-

What DFD characteristics does an analyst examine when evaluating DFD quality?

-

Can a firm generate a 25 percent return on assets and still be technically insolvent (unable to pay its bills)? Explain.

-

Describe surrogacy and the legal and ethical issues that can arise.

-

Anchor Corporation paid cash of $178,000 to acquire Zink Companys net assets on February 1, 20X3. The balance sheet data for the two companies and fair value information for Zink immediately before...

-

I need help with this please: 33 you will be designing and building (using free and/or recycled materials) a complicated gadget that performs a simple task. Through this process, you will demonstrate...

-

Alice J. and Bruce M. Byrd are married taxpayers who file a joint return. Their Social Security numbers are 123-45-6784 and 111-11-1113, respectively. Alices birthday is September 21, 1974, and...

-

Evan is single and has AGI of $277,300 in 2022. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: After all necessary adjustments are...

-

Wipro Limited was founded in 1945 and commenced operations in 1946 as a vegetable oil company. In the early 1980s, Wipro diversified into the Information Technology sector when India witnessed waves...

-

Jordan Mendelson is interested in purchasing a franchise in a meal-preparation business. Customers will come to the business to assemble gourmet dinners and then take the prepared meals to their...

-

When Ben Bernanke, in his tribute to Milton Friedman, said that Regarding the Great Depression . . . we did it, he was referring to the fact that the Federal Reserve at the time did not pursue...

-

How will the following events affect the demand for money? In each case, specify whether there is a shift of the demand curve or a movement along the demand curve and its direction. a. There is a...

-

Dale Emerson served as the chief financial officer for Reliant Electric Company, a distributor of electricity serving portions of Montana and North Dakota. Reliant was in the final stages of planning...

-

David Gain is the chief executive officer (CEO) of Forest Media Corp., which is interested in acquiring RS Communications, Inc. To initiate negotiations, Gain meets with RSs CEO, Gill Raz, on Friday,...

-

Why study stocks if the net amount of stock issues is negative?

-

Software Solution is family-owned business that has been in operation for more than 15 year. The board of directors is comprised of mainly family members, plus a few professionals such as an...

-

One of the key concepts in fiduciary income taxation is that of distributable net income (DNI). List the major functions of DNI on one PowerPoint slide, with no more than five bullets, to present to...

-

One of the key concepts in fiduciary income taxation is that of distributable net income (DNI). List the major functions of DNI on one PowerPoint slide, with no more than five bullets, to present to...

-

One of the key concepts in fiduciary income taxation is that of distributable net income (DNI). List the major functions of DNI on one PowerPoint slide, with no more than five bullets, to present to...

-

Math 300 - Section 3.3 Homework Name Write each statement in the form "ifp, then q." 1. "Today is Tuesday" implies that yesterday was Monday. 2. All integers are rational numbers. 3. No integers are...

-

The advertisement is formed to draw in consumers and convert them into potential buyers. Many people attend the department stores just to try to to shopping . Many of those window shoppers become...

-

Tiffany's Toothpick Tower Tiffany's Toothpick Tower Company manufactures toothpicks for wholesale. The following is information regarding Tiffany's sales over the past year follows: Time Period...

Study smarter with the SolutionInn App