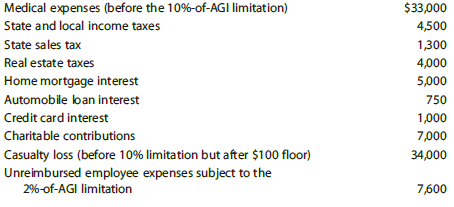

Linda, who files as a single taxpayer, had AGI of $280,000 for 2017. She incurred the following

Question:

Calculate Linda€™s allowable itemized deductions for the year.

Transcribed Image Text:

Medical expenses (before the 10%-of-AGI limitation) $33,000 State and local income taxes 4,500 State sales tax 1,300 Real estate taxes 4,000 Home mortgage interest 5,000 Automobile ban interest 750 Credit card interest 1,000 Charitable contributions 7,000 Casualty loss (before 10% limitation but after $100 floor) Unreimbursed employee expenses subject to the 2%-of-AGI limitation 34,000 7,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (14 reviews)

Lindas itemized deductions before the overall limitation are computed as follows Medical expenses 33...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Linda, age 37, who files as a single taxpayer, had AGI of $280,000 for 2014. She incurred the following expenses and losses during the year: Medical expenses before the 10%-of-AGI limitation ..........

-

Linda, age 37, who files as a single taxpayer, had AGI of $280,000 for 2017. She incurred the following expenses and losses during the year: Medical expenses (before the 10%-of-AGI limitation)...

-

Sylvester files as a single taxpayer during 2018. He itemizes deductions for regular tax purposes. He paid charitable contributions of $7,000, real estate taxes of $1,000, state income taxes of...

-

The receiver most commonly used in AM and FM radio broadcast is the so-called superheterodyne receiver. Answer the following questions about this receiver. a. Draw the block diagram of a...

-

A study published in the American Journal of Physical Anthropology (May 2014) compared the level of inflammation of boys and girls residing in rural Nepal. The C-reactive protein level (a measure of...

-

Water having an average bulk temperature of 100oF flows in a smooth tube with a diameter of 1.25 cm. The flow rate is such that a Reynolds number of 100,000 is experienced, and the tube wall is...

-

Leggere, an Internet book retailer, is interested in better understanding the purchase decisions of its customers. For a set of 1,604 customer transactions, it has categorized the individual book...

-

Data for the North, South, East, and West divisions of Free Bird Company are as follows: a. Determine the missing items, identifying each by the letters (a) through (l). Round percents and investment...

-

Let C' be the curve of intersection of the cylinder 25x + y = 25 and the plane x + y + z = 4. (a) Using t as the parameter where 0

-

In April 2018, Dan is audited by the IRS for the year 2016. During the course of the audit, the agent discovers that Dan's deductions for business travel and entertainment are unsubstantiated and a...

-

Download IRS Form 1099K and its instructions from the IRS website. What is the purpose of the form and when is it used? Go to the Square, Inc. website (www.squareup.com) and search for information...

-

For calendar year 2017, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows: Casualty loss after $100 floor (not covered by insurance)...

-

What is the problem with making cost estimates too conservative or too aggressive?

-

Consider a symmetrical airfoil with 1 m chord in a wind tunnel experiment where free stream velocity is 37 m/s at sea level conditions. Using the flat plate approximation, estimate the viscous drag...

-

When preforming credit risk analysis, try to assess the following: Expected Credit Loss= Chance of Default Loss Given Default Comment on overall assessment of the company's credit risk and chance of...

-

Draft a new customer profitability statement for both alpha hospital and beta hospital using new activity drivers shown below. Work through the following numerical exercise by filling in the template...

-

Why are the liabilities and cash outlays of a property and casualty insurance company more difficult to predict than for a life insurance company?What are the effects of these differences on the P/C...

-

Explain the two methods used for estimating Fishing Mortality rate

-

Use the graph of f in the figure to plot the following functions. a. y = -f(x) b. y = f(x + 2) c. y = f(x - 2) d. y = f(2x) e. y = f(x - 1) + 2 f. y = 2f(x) YA 6. 5- 4- y= fx) 17 i 2 3 4 3 -5 -4 -3...

-

An annual report of The Campbell Soup Company reported on its income statement $2.4 million as equity in earnings of affiliates. Journalize the entry that Campbell would have made to record this...

-

Indicate whether the imputed interest rules apply in the following situations. a. Mike loaned his sister $90,000 to buy a new home. Mike did not charge interest on the loan. The Federal rate was 5%....

-

Indicate whether the imputed interest rules apply in the following situations. a. Mike loaned his sister $90,000 to buy a new home. Mike did not charge interest on the loan. The Federal rate was 5%....

-

Indicate whether the imputed interest rules apply in the following situations. a. Mike loaned his sister $90,000 to buy a new home. Mike did not charge interest on the loan. The Federal rate was 5%....

-

Imagine yourself at a fair playing one of the midway games. Pick a game and calculate the expected value and post your results along with how you calculated them.

-

1. What is the ratio of 2 lengths which are 25 cm and 7.5 m respectively?

-

If f(x, t) does not depend on x, then we have x' = f(t), so that x(t) = (0 to t) f(u)du. Show that, in this case, the RK4 algorithm reduces to Simpson's rule.

Statistical And Computational Techniques In Manufacturing 1st Edition - ISBN: 3642258581 - Free Book

Study smarter with the SolutionInn App