Question:

On June 1, 2018, Skylark Enterprises, a calendar year LLC reporting as a sole proprietorship, acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and the straight-line cost recovery method was used. The property was sold on June 21, 2022, for $385,000.

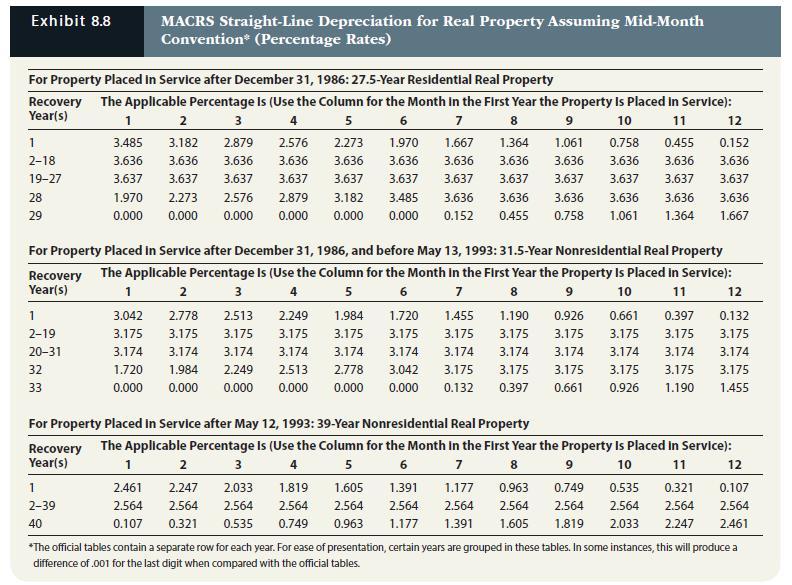

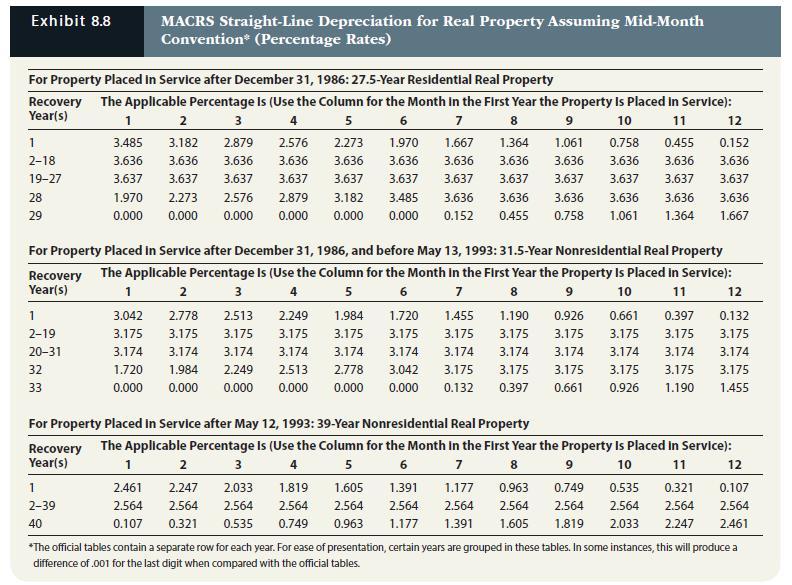

a. Compute the cost recovery and adjusted basis for the building using Exhibit 8.8 from Chapter 8.

b. What are the amount and nature of Skylark’s gain or loss from disposition of the property? What amount, if any, of the gain is unrecaptured § 1250 gain?

Transcribed Image Text:

Exhibit 8.8

For Property Placed in Service after December 31, 1986: 27.5-Year Residential Real Property

Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property is placed in Service):

Year(s)

1

2

3

4

5

6

7

8

10

11

3.485

3.182

2.879

2.576

2.273

1.970

3.636 3.636

3.636 3.636

3.636

3.636

3.637 3.637 3.637 3.637 3.637 3.637

1.970 2.273 2.576 2.879 3.182

0.000

0.000

0.000 0.000 0.000

1

2-18

19-27

28

29

1

2-19

20-31

32

33

MACRS Straight-Line Depreciation for Real Property Assuming Mid-Month

Convention* (Percentage Rates)

For Property Placed in Service after December 31, 1986, and before May 13, 1993: 31.5-Year Nonresidential Real Property

Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Year(s)

3

4

5

6

7

8

9

10

11

1.190

0.926

3.175 3.175

3.174

3.175 3.175 3.175 3.175

0.661 0.926 1.190 1.455

0.397

1

2-39

40

1

2

1.984

3.175

3.042

2.778 2.513 2.249

3.175 3.175

3.175 3.175

3.174 3.174 3.174 3.174 3.174

1.720 1.984 2.249 2.513 2.778

0.000 0.000 0.000 0.000 0.000

2.461

2.564

0.107

9

1.667

1.364

1.061

0.758

3.636 3.636

3.636

3.636

3.637 3.637

3.637

3.636 3.636 3.636 3.636

0.000 0.152 0.455 0.758 1.061 1.364 1.667

3.637

3.485 3.636

3.636

2

2.247

2.564

0.321 0.535

1.720

1.455

3.175

3.175

3.174 3.174 3.174

3.042 3.175

0.000 0.132

0.455

3.636

3.637

0.661

3.175

3.174

12

0.152

3.636

3.637

For Property Placed in Service after May 12, 1993: 39-Year Nonresidential Real Property

Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Year(s)

3

4

5

6

7

8

10

11

2.033

1.819

2.564 2.564

0.749

12

0.397 0.132

3.175

3.175

3.174

3.174

3.175

9

1.605

0.963

0.749

0.535

0.321

1.391 1.177

2.564 2.564

2.564

2.564

2.564 2.564 2.564

0.963 1.177 1.391 1.605 1.819 2.033 2.247

12

0.107

2.564

2,461

*The official tables contain a separate row for each year. For ease of presentation, certain years are grouped in these tables. In some instances, this will produce a

difference of .001 for the last digit when compared with the official tables.