Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2018. The assets of the

Question:

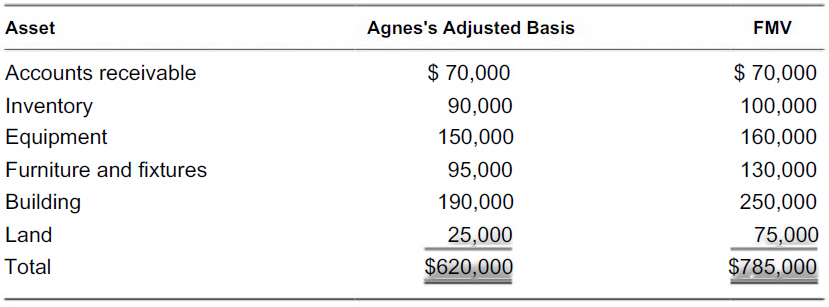

Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2018. The assets of the business are as follows:

a. Calculate Agnes's realized and recognized gain.

b. Determine Rod's basis for each of the assets.

c. Write a letter to Rod informing him of the tax consequences of the purchase. His address is 300 River view Drive, Delaware, OH 43015.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted: