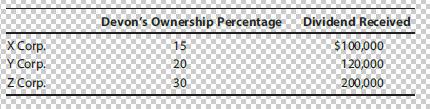

The following chart shows ownership percentages of Devon Corp. in X, Y, and Z Corporations and dividends

Question:

The following chart shows ownership percentages of Devon Corp. in X, Y, and Z Corporations and dividends received by Devon from these corporations in 2016.

Devon is a calendar-year corporation and received no other dividends in 2016. What amount of dividend income must be included by Devon on its 2016 corporate tax return?

a. $126,000

b. $114,000

c. $94,000

d. $106,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answer is Option C C 94000 Explanation A corporations dividendsreceived deduction is ...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

CP5-2 (Algo) Preparing a Bank Reconciliation and Journal Entries and Reporting Cash (LO 5-4, LO 5-5) [The following information applies to the questions displayed below.] The April 30 bank statement...

-

The following chart shows ownership percentages of Devon Corp. in X, Y, and Z Corporations and dividends received by Devon from these corporations in 2017. Devon is a calendar year corporation and...

-

1. Keckye Co. is a calendar year C corporation. When is Keckye's 2017 tax return due? a. March 15, 2018 b. April 16, 2018 c. June 15, 2018 d. October 15, 2018 2. Keckye Co. is a C corporation with a...

-

1. Find the general indefinite integral (x +x)dx 2. Find the general indefinite integral (u +4)(2u +1)du 7/4 1+cos? 0 de cos 0 3. Evaluate the integral . 4. Evaluate the integral by making the given...

-

Determine what order service configuration the Packers should use to achieve their goals, and explain your recommendation. Bob and Carol Packer operate a successful outdoor wear store in Vermont...

-

For 20Y2, Macklin Inc. reported a significant increase in net income. At the end of the year, John Mayer, the president, is presented with the following condensed comparative income statement:...

-

Based on information in this chapter, recommend the most effective HR administrative approach or approaches for the owner of a small business with fewer than 50 employees and infrequent staffing...

-

Consider the following two mutually exclusive projects: Whichever project you choose, if any, you require a 15 percent return on your investment. a. If you apply the payback criterion, which...

-

As altitude increases, does air pressure increase or decrease and Why. And what is the average barometric (air) pressure at sea-level?

-

Identify which of the following cannot function as a pass-through entity for tax purposes. a. Sole proprietorship b. Limited liability company c. Partnership d. S corporation

-

Crimson Corp. was organized as a calendar year corporation in January 2016, incurring $51,000 in qualified organizational expenses, and began business in March 2016. What is the maximum amount...

-

Find the inverse of each matrix in Problem, if it exists. 220 445

-

"How has business communication has changed post pandemic? Are we changing back or changing to new ways?" 1 source with in text citation and please add the source used

-

An investor purchased 100 shares of common stock with a par value of $10.00 for $2,500. Subsequently, 50 of those shares were sold for $1,800. What is the amount of profit or loss from the sale:...

-

you should choose any topic and write the outline by following this way: Introduction Thesis: State in a full sentence your topic, what categories you used for your criteria to judge it, and your...

-

Bob and Larry have been working at their organization for the same amount of time, and they seem to work equally hard at their work and contribute about the same amount to their organization. Bob has...

-

The Role of Financial Statements in Business Decision Making [WLOs: 1, 2, 3] [CLOs: 1, 2] Prior to beginning work on this discussion, please read the articles: Researching Public Companies Through...

-

Astent is a metal mesh cylinder that holds a coronary artery open after a blockage has been removed. However, in many patients the stents, which are made from bare metal, become blocked as well. One...

-

Which of the following raises the credibility of areport? Which of the following raises the credibility of a report? Multiple Choice avoiding predictions avoiding the use of cause-effect statements...

-

Go to www.taxfoundation.org, and determine Tax Freedom Day for your state and a neighboring state for the years 1950, 1960, 1970, 1980, 1990, 2000, and 2010. Report your results as a line graph?"

-

Go to www.taxfoundation.org, and determine Tax Freedom Day for your state and a neighboring state for the years 1950, 1960, 1970, 1980, 1990, 2000, and 2010. Report your results as a line graph?"

-

Although the Federal income tax law is complex, most individual taxpayers are able to complete their tax returns without outside assistance. Gather data as to the accuracy of this statement....

-

Write CSS code that define five classes of paragraph with different background, color, margins, padding and border style

-

5. Suppose we have the following declarations and initializations. Determine what the following statements output. double x 1.1314; double y 900.00; double z 35.4; int num = 1000000; Sample:...

-

Assets Liabilities and Equity Cash $75 Demand deposits $125 15-year commercial loan at 10% 5-year CDs at 6% interest, interest, balloon payment 30-year mortgages at 8% interest, 215 balloon payment...

Study smarter with the SolutionInn App