The KL Partnership is owned equally by Kayla and Lisa. Kaylas basis is $20,000 at the beginning

Question:

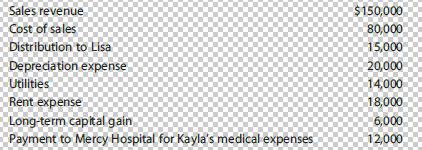

The KL Partnership is owned equally by Kayla and Lisa. Kayla’s basis is $20,000 at the beginning of the tax year. Lisa’s basis is $16,000 at the beginning of the year. Assume that partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year:

a. Determine the ordinary partnership income and separately stated items for the partnership.

b. Calculate Kayla’s basis in her partnership interest at the end of the tax year. What items should Kayla report on her Federal income tax return?

c. Calculate Lisa’s basis in her partnership interest at the end of the tax year. What items should Lisa report on her Federal income tax return?

Step by Step Answer:

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young