The profit and loss statement of Kitsch Ltd., an S corporation, shows $100,000 book income. Kitsch is

Question:

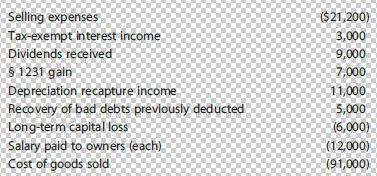

The profit and loss statement of Kitsch Ltd., an S corporation, shows $100,000 book income. Kitsch is owned equally by four shareholders From supplemental data, you obtain the following information about items that are included in book income.

a. Compute Kitsch’s nonseparately stated income or loss for the tax year.

b. What would be the share of this year’s nonseparately stated income or loss items for James Billings, one of the Kitsch shareholders?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted: