Tristan, who is single, operates three sole proprietorships that generate the following information in 2019 (none are

Question:

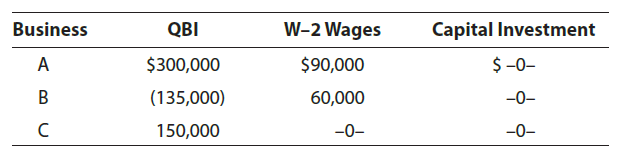

Tristan, who is single, operates three sole proprietorships that generate the following information in 2019 (none are ?specified services? businesses).

Tristan chooses not to aggregate the businesses. She also earns $150,000 of wages from an unrelated business, and her modified taxable income (before any QBI deduction) is $380,000.a. What is Tristan?s QBI deduction?b. Assume that Tristan can aggregate these businesses. Determine her QBI deduction if she decides to aggregate the businesses.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2020 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357109168

43rd Edition

Authors: William A. Raabe, James C. Young, William H. Hoffman, Annette Nellen, David M. Maloney

Question Posted: