Wally, Inc., sold the following three personal property assets in year 6: What is Wally's Section 1245

Question:

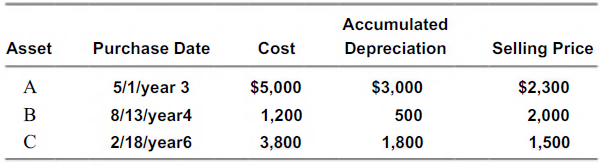

Wally, Inc., sold the following three personal property assets in year 6:

What is Wally's Section 1245 recapture in year 6?

a. $500 loss

b. $300 gain

c. $800 gain

d. $1,600 gain

Transcribed Image Text:

Accumulated Purchase Date Selling Price Asset Cost Depreciation 5/1/year 3 A $5,000 $3,000 $2,300 B 1,200 8/13/year4 500 2,000 1,800 1,500 2/18/year6 3,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 45% (11 reviews)

c ...View the full answer

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

Section 1245 recapture applies to which of the following? a. Section 1231 real property sold at a gain with accumulated depreciation in excess of straight line. b. Section 1231 personal property sold...

-

Robert is the sole shareholder and CEO of ABC, Inc., an S corporation that is a qualified trade or business. During the current year, ABC records net income of $325,000 after deducting Roberts...

-

Assume the same facts as in Problem 35, except that the business is a specified services" business (e.g., a consulting firm) owned equally by Elliot and Conrad (an unrelated individual) in a...

-

A mover lifts a 50 lbm box off the ground and places it on a truck (Figure 1-21). If the floor of the truck is 4 feet off the ground, how much work was required to lift the box? 4 ft 50 lbs...

-

Draw the Hasse diagram for the poset (P(U), ), where U = {1, 2, 3, 4}.

-

The secant function has an infinite number of critical points where an absolute maximum occurs. Determine whether each of the following statements is true or false, and explain why.

-

Jupiter's is considering an investment in time and administrative expense on an effort that promises one large payoff in the future, followed by additional expenses over a 10-year horizon. The cash...

-

Heisey Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum,...

-

Let 1 f(z) = (2-1)(x-2) Find the Laurent expansion of f about z = 0 in the region {ze C: 1

-

The Football Bowl Subdivision (FBS) level of the National Collegiate Athletic Association (NCAA) consists of over 100 schools. Most of these schools belong to one of several conferences, or...

-

Wally, Inc., sold the following three personal property assets in year 6: What is Wallys net Section 1231 gain or loss in year 6? a. $500 loss b. $300 gain c. $800 gain d. $1,600 gain Accumulated...

-

Net Section 1231 losses are: a. Deducted as a capital loss against other capital gains and nothing against ordinary income b. Deducted as a capital loss against other capital gains and up to $3,000...

-

Identify a decision you made that had important unintended consequences. Were the consequences good, bad or both? Should you and could you have done anything differently in making the decision?

-

A space station shaped like a giant wheel has a radius of 151 m and a moment of inertia of 4.81 10 8 kg m 2 . A crew of 150 lives on the rim, and the station is rotating so that the crew...

-

A closed tube has a diameter of 0.042 m when it is vibrating the 2nd overtone. The velocity of sound is 345 m/sec. If the frequency of the sound is 440 Hz, what is the length of the tube?

-

1. Youd like to buy a small ranch when you retire in 37 years. You estimate that in 37 years youll need $9 million to do so. If you can earn 1.0% per month, how much will you need to invest each...

-

5. Selected operating data for two divisions of Ashley Company is given below: NORTH SOUTH Sales 720,000 600,000 Total Assets 360,000 200,000 Fixed Assets 140,000 150,000 Total Liabilities 120,000...

-

What is the Balance Sheet Year? If Ended December 31, 2023 Assets Cash 87,000 Accounts Receivable 1 11,000 Inventory 367,000 Other Current Assets 45,000 Total Current Assets 610,000 Property.

-

Write about the Security Policy and Security Design and the general security architecture of the company Complete the following deliverables for the assignment: Determine the most important assets...

-

Why did management adopt the new plan even though it provides a smaller expected number of exposures than the original plan recommended by the original linear programming model?

-

Sandstorm Corporation decides to develop a new line of paints. The project begins in 2021. Sandstorm incurs the following expenses in 2021 in connection with the project: Salaries...

-

Ella and Emma are twin sisters who live in Louisiana and Mississippi, respectively. Ella is married to Frank, and Emma is married to Richard. Frank and Richard are killed in an auto accident in 2021...

-

Liam owns a personal use boat that has a fair market value of $35,000 and an adjusted basis of $45,000. Liams AGI is $100,000. Calculate the realized and recognized gain or loss if: a. Liam sells the...

-

Using a Counter-Controlled While Loop To prompt the user to create 3 usernames and passwords. (JAVA)?

-

The answer has been helpful thank you, but yes could you provide the driver class in a separate message?

-

in matlab please. You are to use the same Script File as Homework 4B: Part 1 Create a Function File that takes in the following 2 vectors from your HW 4B script. The function shall be able to accept...

Study smarter with the SolutionInn App