Compute the 2020 fiduciary income tax return (Form 1041) and Federal income tax for the Green Trust.

Question:

Compute the 2020 fiduciary income tax return (Form 1041) and Federal income tax for the Green Trust. Prepare a spreadsheet solution to make your computations. Then complete a Form 1041 for the entity and a Schedule K–1 for beneficiary Marcus.

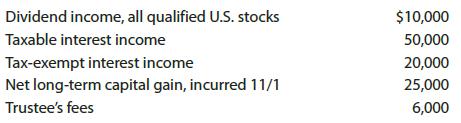

In addition, determine the amount and character of the income and expense items that each beneficiary must report for the year. The trust is not subject to the AMT. The year’s activities of the trust include the following.

Under the terms of the trust instrument, cost recovery, net capital gains and losses, and administrative fees are allocable to corpus. The trustee is required to distribute $25,000 to Marcus every year. For the year, the trustee distributed $40,000 to Marcus and $40,000 to Marcus’s sister, Ellen Hayes. No other distributions were made. In computing DNI, the trustee properly assigned all of the deductible trustee fees to the taxable interest income.

The trustee paid $4,000 in estimated taxes for the year on behalf of the trust. Any resulting refund is to be credited to the next tax year. The exempt income was not derived from private activity bonds.

The trust was created on December 14, 1953. It is not subject to any recapture taxes, nor can it claim any tax credits. None of its income was derived under a personal services contract. The trust has no economic interest in any foreign trust. Its Federal identification number is 11-1111122.

The trustee, Wisconsin State National Bank, is located at 3100 East Wisconsin Avenue, Milwaukee, WI 53201. Marcus lives at 9880 East North Avenue, Shorewood, WI 53211. His Social Security number is 123-45-6788. Ellen lives at 6772 East Oklahoma Avenue, Milwaukee, WI 53204. Her Social Security number is 987-65-4321.

Step by Step Answer:

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman