Emily, who is single, sustains an NOL of $7,800 in 2018. The loss is carried forward to

Question:

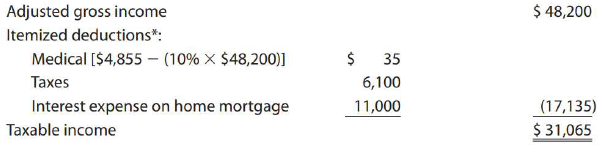

Emily, who is single, sustains an NOL of $7,800 in 2018. The loss is carried forward to 2019. For 2019, Emily's income tax information before taking into account the 2018 NOL is as follows:

How much of the NOL carryforward can Emily use in 2019, and what is her adjusted gross income and her taxable income?

Transcribed Image Text:

Adjusted gross income Itemized deductions": Medical [$4,855 – (10% X $48,200)] Taxes Interest expense on home mortgage Taxable income $ 48,200 $ 35 6,100 (17,135) 11,000 $ 31,065

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

When an NOL is carried forward the taxable income and income ta...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Individual Income Taxes

ISBN: 9781337702546

42nd Edition

Authors: James C. Young, William H. Hoffman, William A. Raabe, David M. Maloney, Annette Nellen

Question Posted:

Students also viewed these Business questions

-

Emily who is single; sustains an NOL of $7,800 in 2015. The loss is carried back to. For 2013, Emily's income tax information was as follows: Adjusted income2013 $ 38,200 Itemized deduction Medical $...

-

Emily, who is single, sustains an NOL of $7,800 in 2017. The loss is carried back to 2015. For 2015, Emilys income tax information was as follows: As a result of the carryback, what is Emilys...

-

Goose Corporation, a C corporation, incurs a net capital loss of $12,000 for 2018. It also has ordinary income of $10,000 in 2018. Goose had net capital gains of $2,500 in 2014 and $5,000 in 2017. a....

-

A room is 6 m by 5 m by 3 m. (a) If the air pressure in the room is 1 atm and the temperature is 300 K, find the number of moles of air in the room. (b) If the temperature rises by 5 K and the...

-

Five kilograms of liquid carbon tetrachloride undergo a mechanically reversible, iso- haric change of state at I bar during which the temperature changes from 0(C to 20(C. Determine (V1, W, , (H1,...

-

What is the smallest common multiple of 160 and 240?

-

Ormet Primary Aluminum Corporation, operated an aluminum smelter plant in Hannibal, Ohio. The facility ceased production in October 2013 in order to liquidate its assets after filing for bankruptcy...

-

I think we goofed when we hired that new assistant controller,? said Ruth Scarpino, president of Provost Industries. ?Just look at this report that he prepared for last month for the Finishing...

-

rephrase.PCG REPORTED THAT THE FACILITY HAS REQUESTED THE FAMILY NOT VISIT FOR TWO WEEKS TO ALLOW PT TO ADJUT TO THE NEW FACILITY. PCG HARED HER CONCERNS ABUT NOT BEING ABLE TO VISIT PT AND PT...

-

Solve the following equation for x and check your answer. 7e3x = 21.

-

Belinda spent the last 60 days of 2018 in a nursing home. The cost of the services provided to her was $18,000 ($300 per day). Medicare paid $8,500 toward the cost of her stay. Belinda also received...

-

Soong, single and age 32, had the following items for the tax year 2018: Salary of $ 30,000. Interest income from U.S. government bonds of $2,000. Dividends from a foreign corporation of $ 500 ...

-

Rick, who is single, has been offered a position as a city landscape consultant. The position pays $125,000 in cash wages. Assume Rick has no dependents. Rick deducts the standard deduction instead...

-

Suppose that movements in stock and option prices are governed perfectly by your multi-period binomial trees. Explain why you cannot set up a portfolio of long positions in the stock and in European...

-

1.How breakdowns in stock correlation limit diversification benefits during the pandemic (Tresury bonds are typically useful)? 2. How stock diversification reduces unique risk but does not eliminate...

-

The ____ the number of stocks in a portfolio and the ____ the time period, the ____ the portfolio beta. a.smaller, longer, more stable b.larger, shorter, less stable c.larger, longer, more stable...

-

Question 5: Estimates for one of two process upgrades are: first cost of $40,000; annual costs of $5000 per year; market value that decreases 5% per year to the salvage value of $20,000 after the...

-

How to transform a bond 98-03 3/4 to decimals in excel?

-

Plaintiff Advance Industrial Coating, LLC brought a suit against defendant Westfield Insurance Company based on diversity jurisdiction. The plaintiff alleged that the defendant was an Ohio...

-

Match the following. Answers may be used more than once: Measurement Method A. Amortized cost B. Equity method C. Acquisition method and consolidation D. Fair value method Reporting Method 1. Less...

-

For 2015, Ashley has gross income of $8,500 and a $5,000 long-term capital loss. She claims the standard deduction. Ashley is 35 years old and single with two dependent children. How much of Ashley's...

-

Jane and Blair are married taxpayers filing jointly and have 2015 taxable income of $97,000. The taxable income includes $5,000 of gain from a capital asset held five years, $2,100 of gain from a...

-

For 2015, Wilma has properly determined taxable income of $36,000, including $3,000 of un-recaptured 1250 gain and $8,200 of 0%/15%/20% gain. Wilma qualifies for head-of-household filing status....

-

QUESTION to answer for the Company Nuvalent, INC: VI. Implementation, Evaluation and Control of Strategies (This is all estimations) a. Explain in more detail how each recommended strategy within the...

-

a. Explain the results of ANOVA analysis using hypothesis testing procedure (5 marks). Descriptives ***My favourite sports person acts as a role model for me 95% Confidence Interval for Mean N Mean...

-

Galt Motors currently produces 50,000 electric motors a year and expects output levels to remain steady in the future. It buys armatures from an outside supplier at a price of $2.00 each. The plant...

Study smarter with the SolutionInn App