The KL Partnership is owned equally by Kayla and Lisa. Kaylas basis is $20,000 at the beginning

Question:

The KL Partnership is owned equally by Kayla and Lisa. Kayla’s basis is $20,000 at the beginning of the tax year. Lisa’s basis is $16,000 at the beginning of the year. Assume partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year:

Sales revenue ..................... $150,000

Cost of sales ...................... 80,000

Distribution to Lisa .................... 15,000

Depreciation expense................... 20,000

Utilities ........................ 14,000

Rent expense ...................... 18,000

Long-term capital gain .................. 6,000

Payment to Mercy Hospital for Kayla’s medical expenses ..... 12,000

a. Prepare a Microsoft Excel spreadsheet that could be used in a CPA firm to accumulate KL’s information that would be reported on Form 1065, page 1 [Ordinary business income (loss)] and page 4 (Schedule K). Include calculations and subtotals to ensure the spreadsheet will automatically update if the information changes. How much is the partnership’s ordinary income on page 1? What information is shown on Schedule K?

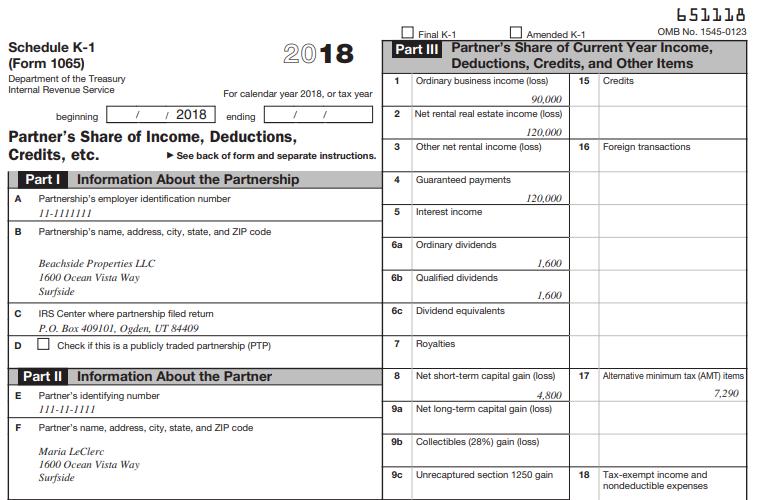

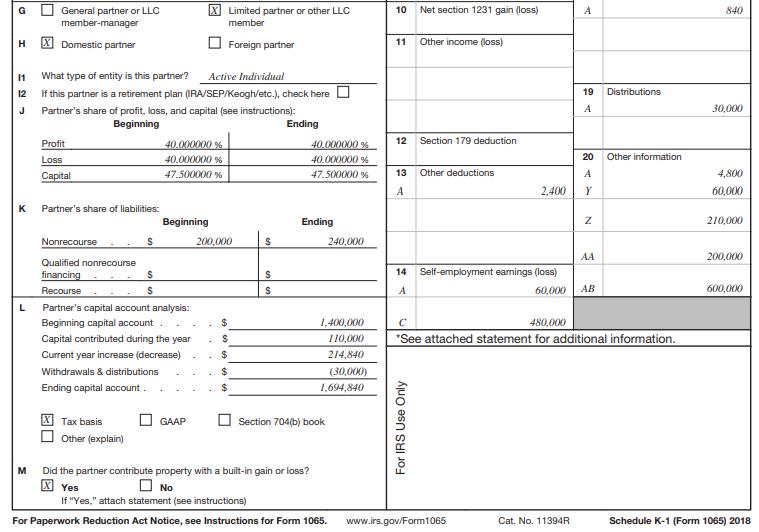

b. Use the information in part (a) to prepare Form 1065, pages 1 and 4 (Schedule K) for the KL Partnership. On page 1, omit items A to J at the top if the facts do not provide that information. For Schedule K, line 14, assume both partners are active in the partnership.

c. Add columns to your spreadsheet to allocate amounts to Kayla and Lisa. (For this requirement, disregard the income from self-employment and information related to the qualified business income deduction.) Show the partners’ allocation percentages at the top of their columns, and use those percentages in formulas to allocate any separately stated items that should be allocated. (Note that some items are directly assigned to a partner.) What information will be shown on Kayla’s and Lisa’s Schedules K–1, Part III? What items will Kayla and Lisa report on their Federal income tax returns?

d. Expand your spreadsheet. Add rows for beginning basis and ending basis below Kayla’s and Lisa’s columns, and calculate each partner’s ending basis in the partnership interest. How do you make this calculation? What is each partner’s basis in her partnership interest at the end of the tax year?

e. Consider the results if the partnership’s revenues were $100,000 instead of $150,000. What happens if you update the revenues line on your spreadsheet? Are your new amounts correct for the Form 1065/Schedule K information, Schedule K–1 information, and partners’ bases? Why or why not? What conclusions can you draw?

Schedule K–1

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young