The Parakeet Partnership was formed on August 1 of the current year and admitted Morlan and Merriman

Question:

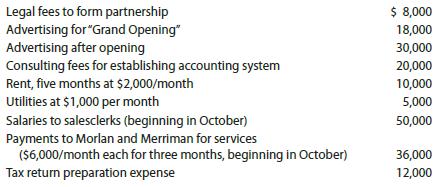

The Parakeet Partnership was formed on August 1 of the current year and admitted Morlan and Merriman as equal partners on that date. The partners both contributed $300,000 of cash to establish a children’s clothing store in a local shopping mall. The partners spent August and September buying inventory, equipment, supplies, and advertising for their “Grand Opening” on October 1. Following are some of the costs the partnership incurred during its first year of operations.

In addition, on October 1, the partnership purchased all of the assets of Granny Newcombs, Inc. Of the total purchase price for these assets, $200,000 was allocated to the trade name and logo.

Determine how each of these costs is treated by the partnership, and identify the period over which the costs can be deducted.

Step by Step Answer:

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman