Question: Roybuilt Machines has computerized its fixed-asset records during the past year. The company feels that the conversion was completed with only minor errors in recording

Roybuilt Machines has computerized its fixed-asset records during the past year. The company feels that the conversion was completed with only minor errors in recording useful lives and depreciation methods, but, based on past experience, you are not so sure. When Roybuilt Machines converted its inventory system two years ago, almost 25% of the items were incorrectly priced. You have satisfied yourself as to the fixed-asset costs by means by other tests, and want to apply difference estimation sampling to test the depreciation expense for the year.

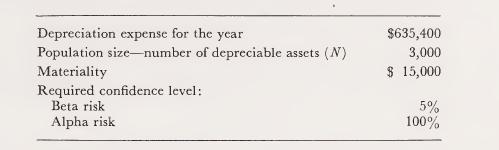

The following data are available or have been developed by you:

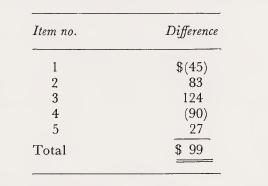

You have no prior experience with the fixed-assets data file, so you select a preliminary sample of 50 items in order to estimate the standard deviation. The results are as follows (understatements are in parentheses):

For the other 45 items in the sample, there are no differences.

Required :

a. What is the sample size necessary to achieve your audit objectives?

b. Is it valid to include the 50 items from the preliminary sample in your final sample analysis?

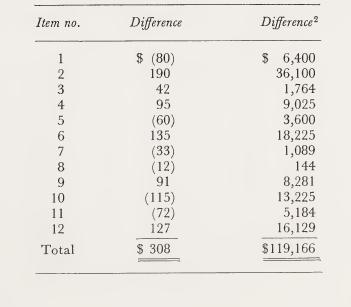

c. Ignoring your answers to part a, assume that you select 150 additional items and the following differences between book and audited values are identified. (Understatements are in parentheses.)

Calculate the confidence interval at the required confidence level based on your sample (i.e., total sample of 200 items), d.What audit conclusion would you reach based on this analysis? Would an adjusting entry be necessary? If so , for what amount?

Depreciation expense for the year Population size-number of depreciable assets (N) Materiality Required confidence level: Beta risk Alpha risk $635,400 3,000 $ 15,000 5% 100%

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Solutions Step 1 Solution Lets correct each error a Date Account Dr Cr 1Jan Equipment 36000 Accumulated Depreciation 4230 Retained Earnings 31770 Work... View full answer

Get step-by-step solutions from verified subject matter experts