The president of the American Insurance Institute wants to compare the yearly costs of auto insurance offered

Question:

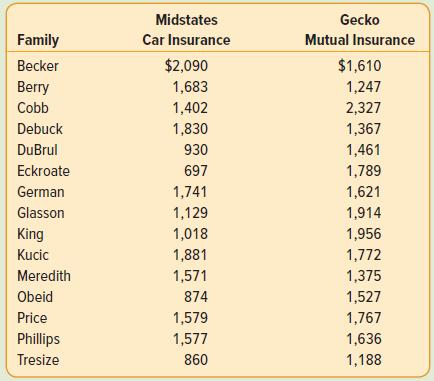

The president of the American Insurance Institute wants to compare the yearly costs of auto insurance offered by two leading companies. He selects a sample of 15 families, some with only a single insured driver, others with several teenage drivers, and pays each family a stipend to contact the two companies and ask for a price quote. To make the data comparable, certain features, such as the deductible amount and limits of liability, are standardized. The data for the sample of families and their two insurance quotes are reported in the table. At the .10 significance level, can we conclude that there is a difference in the amounts quoted?

a. What are the null and alternate hypotheses?

b. Compute the test statistic.

c. Compute the p-value.

d. What is your decision regarding the null hypothesis?

e. Interpret the result.

Step by Step Answer:

Statistical Techniques In Business And Economics

ISBN: 9781260239478

18th Edition

Authors: Douglas Lind, William Marchal, Samuel Wathen