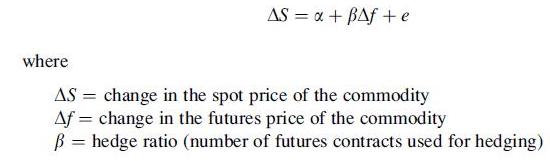

In finance we are sometimes interested in hedging the risk associated with future price changes by using

Question:

In finance we are sometimes interested in hedging the risk associated with future price changes by using futures contracts. A futures contract allows the buyer of the contract to buy the commodity at a later date at a price that is agreed upon now. By purchasing the correct number of contracts, an investor can reduce or even eliminate his or her risk. The correct number of contracts to purchase is known as the hedge ratio, and it can be estimated by regression analysis. The regression to be estimated is

Suppose you collect 30 daily spot and future prices over a 1-year period and estimate β to be 3.32 with a standard error of 1.12. Construct a 95 % confidence interval around the hedge ratio β.

Step by Step Answer:

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee